OUR PROFILE

WHO WE ARE

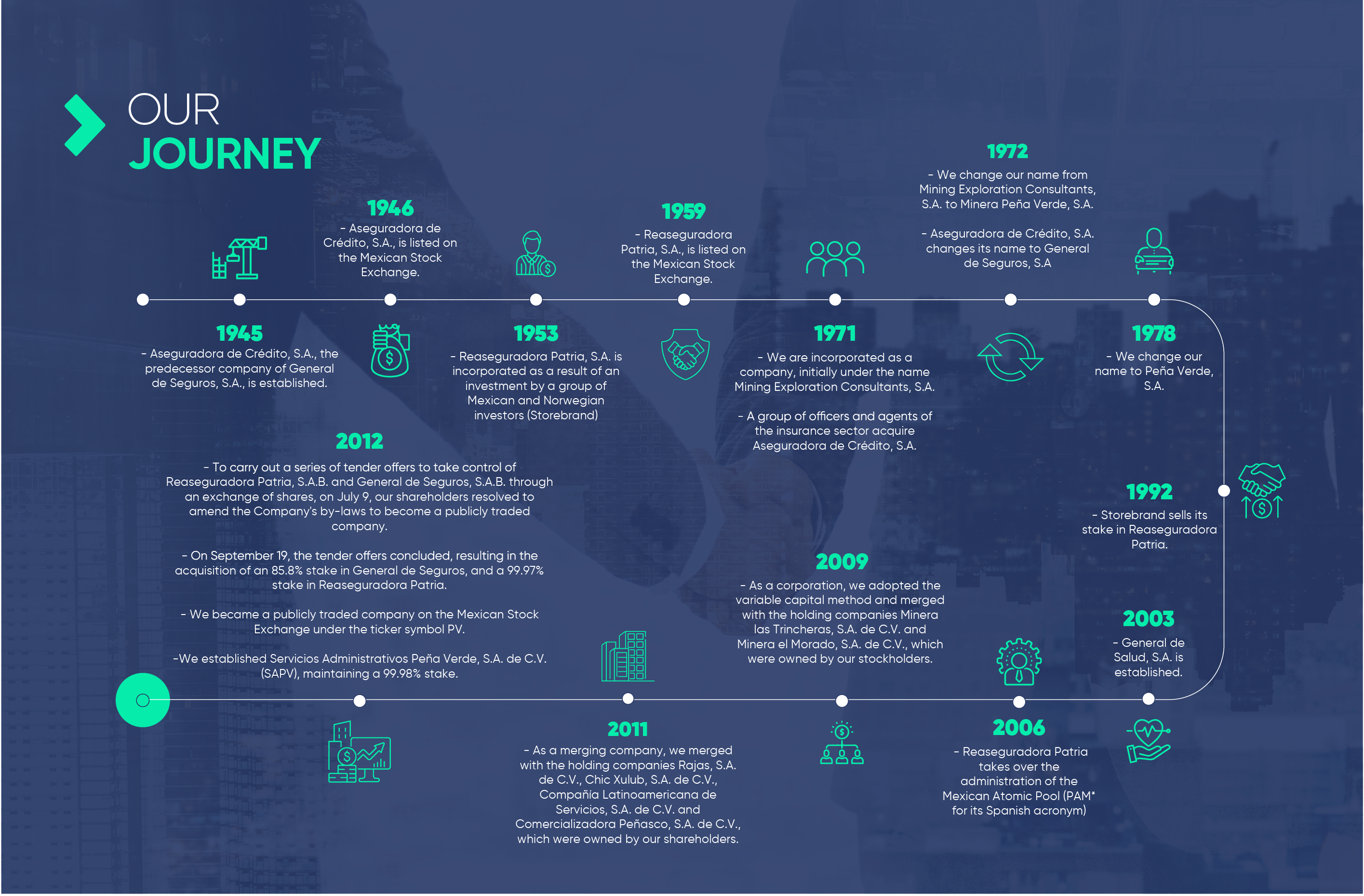

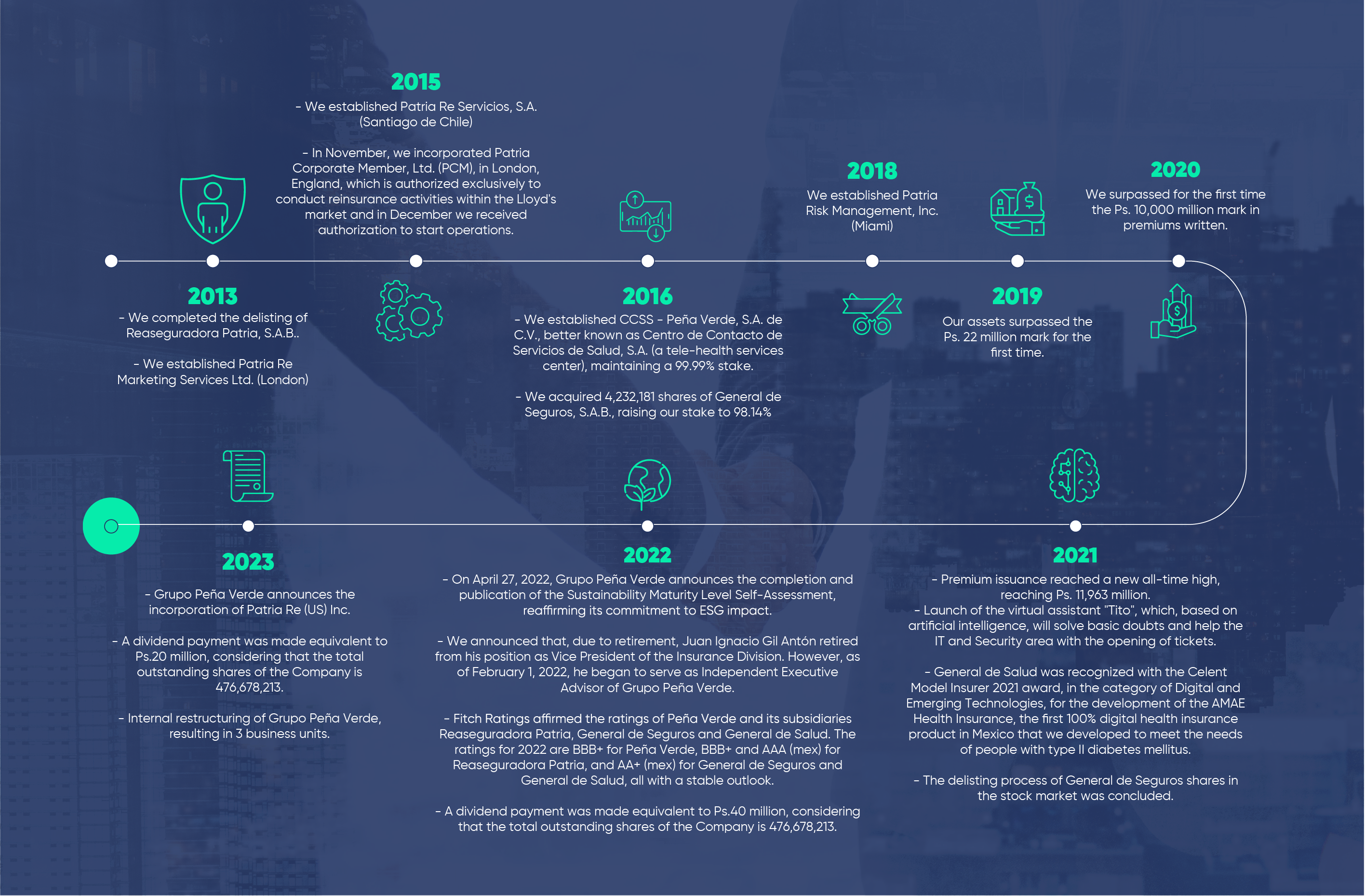

From its beginning to its final settlement, Grupo Peña Verde has stood out as the only Mexican conglomerate specialized in comprehensive risk management. In this sense, the companies through which most of the Group’s activities are carried out are General de Seguros, General de Salud y Reaseguradora Patria.

With the goal of stimulating business growth, consolidating a robust Corporate Governance and taking advantage of the synergies and efficiencies inherent to our set of businesses, the entire operation is backed by a corporate entity, which operates under the trade name of Peña Verde and has the legal name of Peña Verde S.A.B. (being a Mexican stock corporation with an unlimited duration). In addition, it has been listed on the Mexican Stock Exchange since 2012, identified with the ticker symbol PV.

The corporate offices of Reaseguradora Patria and Peña Verde are located at Periférico Sur 2771, Col. San Jerónimo Lídice, Alcaldía La Magdalena Contreras, C.P. 10200, Mexico City, with telephone number 5683-4900. As for the main offices of General de Seguros, they are located at Avenida Patriotismo #266, Col. San Pedro de los Pinos, C.P. 03800, Mexico City. In addition, we have more than 22

commercial branches to provide top quality service to our customers, always guided by our cultural motto: the customer, my priority.

>>OUR VALUES

The values presented below constitute the fundamental framework within which Grupo Peña Verde’s strategy is built and implemented:

BUSINESS UNITS

The following are the three business units that make up Grupo Peña Verde:

Risk management activities are consolidated through the Insurance and Reinsurance Units. The Servicios Administrativos Peña Verde subsidiary, where the Business Transformation and Financial Strategy Unit (UTEEF) is located, has the goal of establishing an organizational culture that stimulates participation and innovation in Grupo Peña Verde. Thus, contributing to the strengthening of competitiveness in all of the group’s business units.

In summary, the Group employs two strategies to create value. On the one hand, the income generated by our operations is used for investments and generates an operating margin. On the other hand, our investment portfolios not only increase profit margins, but also play a crucial role in diversifying risk.

INSURANCE

General de Seguros

With more than 50 years of experience in the Mexican insurance market, our company has provided its clients with a wide variety of products for the protection of life, vehicles, casualty, and in particular, in the agricultural field, being one of the few insurance companies that offers this coverage. Through General de Salud, we also provide services in the areas of medical expenses and health. In addition, it is important to mention that General de Seguros is authorized to operate in credit insurance and reinsurance.

Throughout its outstanding trajectory in the Mexican insurance and surety (non-pension) market, General de Seguros has revalidated its commitment to timely and efficient service. As a result, by the end of 2023, it has reached the #32 position in the Mexican insurance and surety (non-pension) market.

In 2023, we are proud to have more than 50 years of history protecting our customers.

General de Salud

With an outstanding experience that exceeds 15 years, this insurance company is of Mexican origin and operates as a subsidiary of General de Seguros. Its main focus is on providing insurance in the health insurance field.

To meet both personal needs and those of small and medium-sized companies (SMEs), General de Salud offers group plans ranging from primary coverage, such as consultations and prevention, to comprehensive coverage that includes ancillary services, hospitalization, maternity, dentistry, among others.