CONSOLIDATED FINANCIAL STATEMENTS

Peña verde, S. A. B. and subsidiaries

AUDITED CONSOLIDATED

FINANCIAL STATEMENTS

December 31, 2023

INDEPENDENT

AUDITOR’S REPORT

To the Audit Committee, the Board of Directors and the Shareholders of Peña Verde, S.A.B. and subsidiaries

We have audited the consolidated financial statements of Peña Verde, S.A.B. and subsidiaries (the Institution), which include the consolidated balance sheet as of December 31, 2023, and the consolidated statements of income, changes in stockholders’ equity and cash flows for the year then ended, as well as the notes to the consolidated financial statements, which include significant accounting policy information and other explanatory information.

In our opinion, the accompanying consolidated financial statements of Peña Verde, S.A.B. and subsidiaries as of December 31, 2023 and for the year then ended have been prepared, in all material respects, in accordance with the accounting standards applicable to insurance institutions in Mexico, issued by the National Insurance and Bonding Commission (the Commission).

Basis of the OpinionWe have conducted our audit in accordance with International Standards on Auditing (ISA). Our responsibilities under these standards are further described in the “Responsibilities of the Auditors for the Audit of the Consolidated

Financial Statements” section of our report. We are independent of the Institution in accordance with the “International Code of Ethics for Professional Accountants (including International Standards of Independence)” (“IESBA Code”), and the ethical requirements of the Code of Professional Ethics of the Mexican Institute of Public Accountants, A.C. that are relevant to our audits of consolidated financial statements in Mexico, and we have complied with other ethical responsibilities in accordance with the Code of Accounting. IESBA and the ethical requirements of the Code of Professional Ethics of the Mexican Institute of Public Accountants, A.C. We consider that the audit evidence we have obtained provides a sufficient and adequate basis to support our opinion.

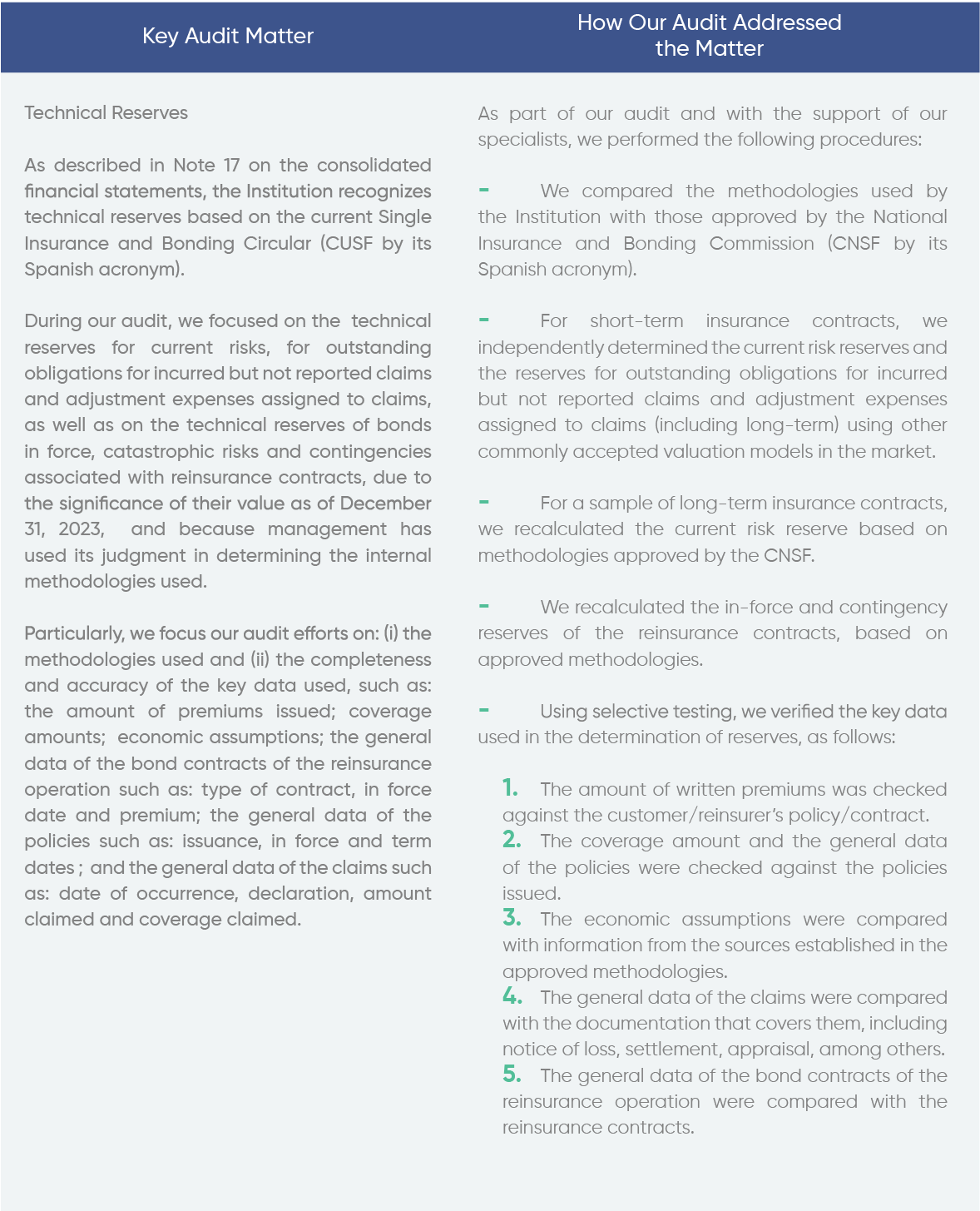

Key Audit Matters

Key audit matters are issues that, in our professional judgment, have been of the greatest importance in our audit of the current year’s consolidated financial statements. These matters have been considered in the context of our audit of the consolidated financial statements as a whole and in forming our opinion on the consolidated financial statements, therefore, we do not express a separate opinion on these matters.

Additional information

The Management of the Institution is

responsible for the additional information

submitted. This additional information includes

the Annual Report submitted to the National

Banking and Securities Commission (CNBV by

its Spanish acronym), which will be issued after

the date of this report.

This additional information is not covered by this opinion on the consolidated financial statements, and we will not express any audit opinion on it.

However, in connection with our audit of the Institution’s consolidated financial statements, it is our responsibility to read this additional information when it becomes available and to assess whether such information is materially inconsistent with the consolidated financial statements or our knowledge acquired through our audit or appears to contain a material misstatement under other circumstances.

When we read the additional information that we have not yet received, we must issue the declaration on the Annual Report required by the CNBV and if we detect that there is a material error in it, we must communicate it to those in charge of the governance of the Institution and in said report, if applicable.

Responsibilities of Management and Governance Officers in Relation to the Consolidated Financial StatementsThe Management of the Institution and subsidiaries is responsible for the preparation of the consolidated financial statements, in accordance with the accounting criteria

applicable to insurance institutions in Mexico, issued by the Commission, and such internal control as it considered necessary to allow the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

When preparing the consolidated financial statements, Management is responsible for assessing the Institution’s ability to continue as a going concern; disclosing, where applicable, issues related to going concern and using the going concern accounting basis, unless the Management intends to liquidate the Institution or cease operations, or there is no more realistic alternative to doing so.

Those charged with the governance of the Institution are responsible for overseeing the Institution’s financial reporting process.

Other matterThis version of our report is a translation from the original report, which was prepared in Spanish. In all matters of interpretation of information, views or opinions, the original Spanish language version of our report takes precedence over this translation.

Responsibilities of the Auditors for the Audit of the Consolidated Financial StatementsOur objectives are to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement, whether due to fraud or error, and to issue an audit report containing our opinion. Reasonable assurance is a high level of assurance, but it does not guarantee that an audit conducted in accordance with ISAs

will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions that users make on the basis of the consolidated financial statements.

As part of conducting an audit in accordance with ISA, we exercise our professional judgment and maintain professional skepticism. We also:

- Identify and evaluate the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and implement audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than one resulting from an unintentional error, as fraud may involve collusion, forgery, deliberate omissions, intentional misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate under the circumstances, and not for the purpose of expressing an opinion on the effectiveness of the Institution’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by Management.

- Evaluate on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Institution’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Institution to cease to continue as a going concern.

- Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Institution and subsidiaries to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the audit of the Institution and subsidiary audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance of the Institution, among other things, the planned scope and timing of the audit and the significant findings of the audit, as well as any significant internal control deficiencies that we identify during of our audit.

We also provide those in charge of the governance of the Institution with a statement stating that we have complied with the applicable ethical requirements on independence and we communicate to them all relationships and other issues that could reasonably influence our independence, and where appropriate, the corresponding actions taken to eliminate the threats or safeguards applied.

Among the issues communicated to those charged with the governance of the Institution, we identified those that have been of greatest importance in the audit of the consolidated financial statements for the current financial year and that are, therefore, the key issues of the audit. We describe such matters in our audit report unless they are prohibited by law or regulation from being publicly disclosed or, in extremely rare circumstances, we determine that an issue should not be disclosed in our report because it can reasonably be expected that the adverse consequences of doing so would outweigh the public interest benefits.

The name of the partner in charge of the audit is reported below.

PricewaterhouseCoopers, S. C.

C.P.C Rafael Gutiérrez Lara44

Audit Partner

Mexico City, April 26, 2024

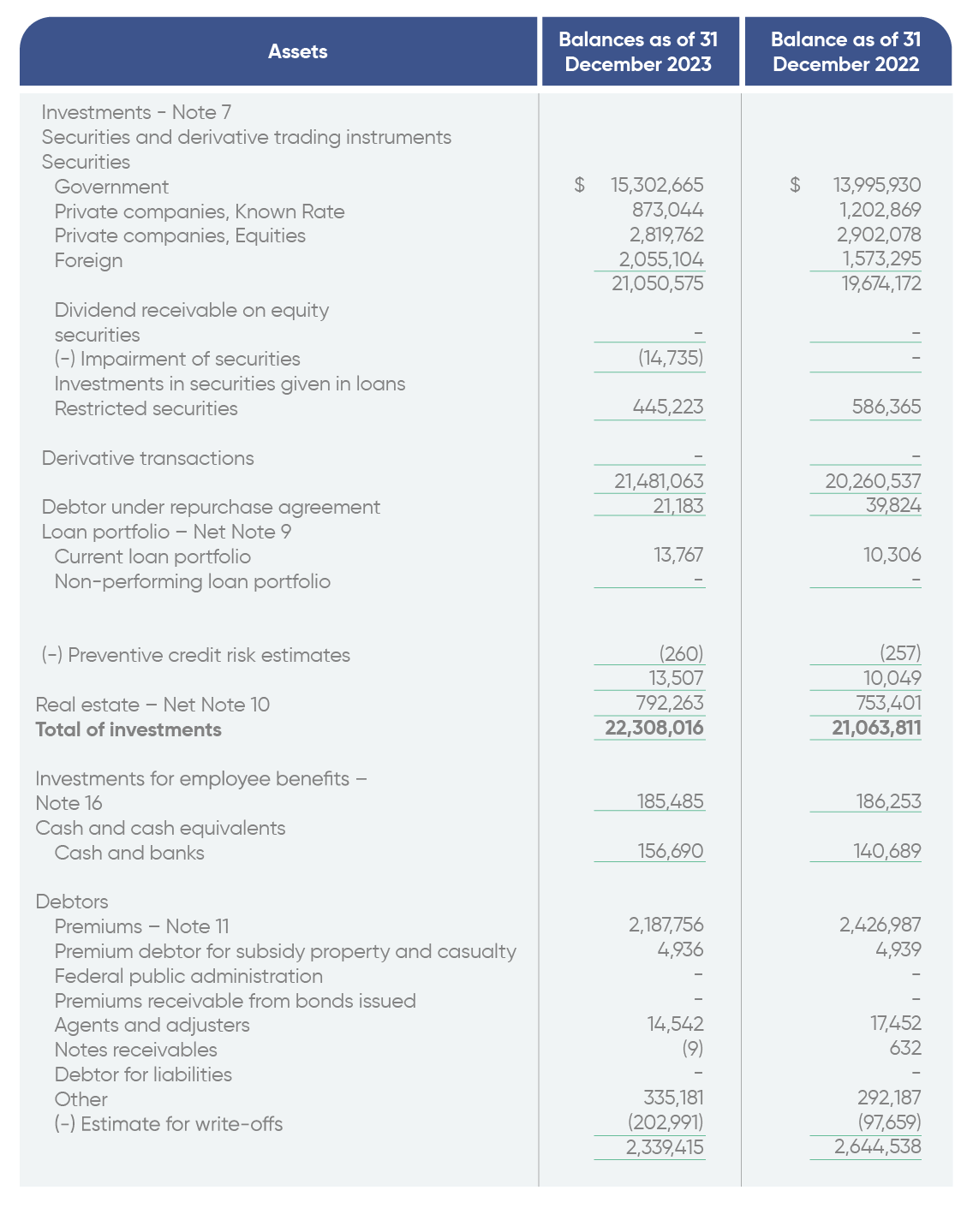

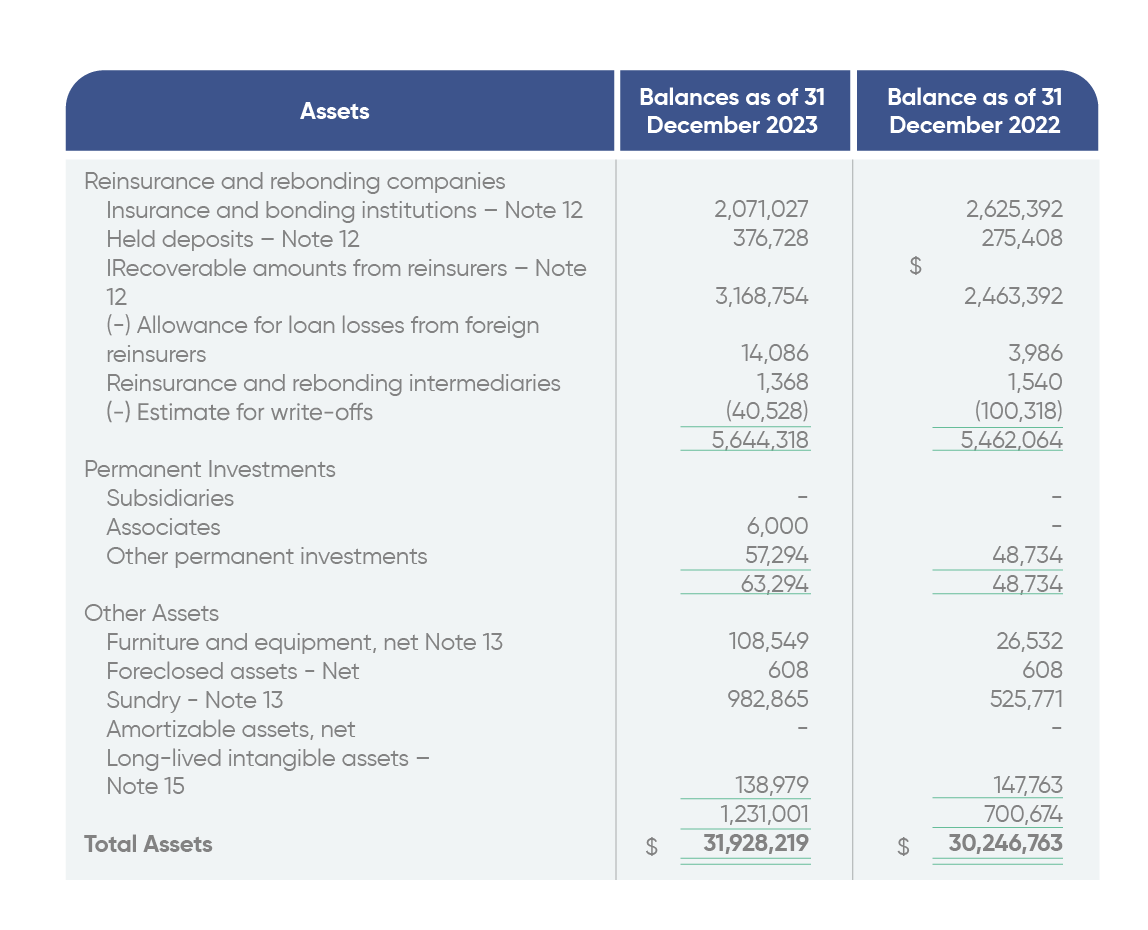

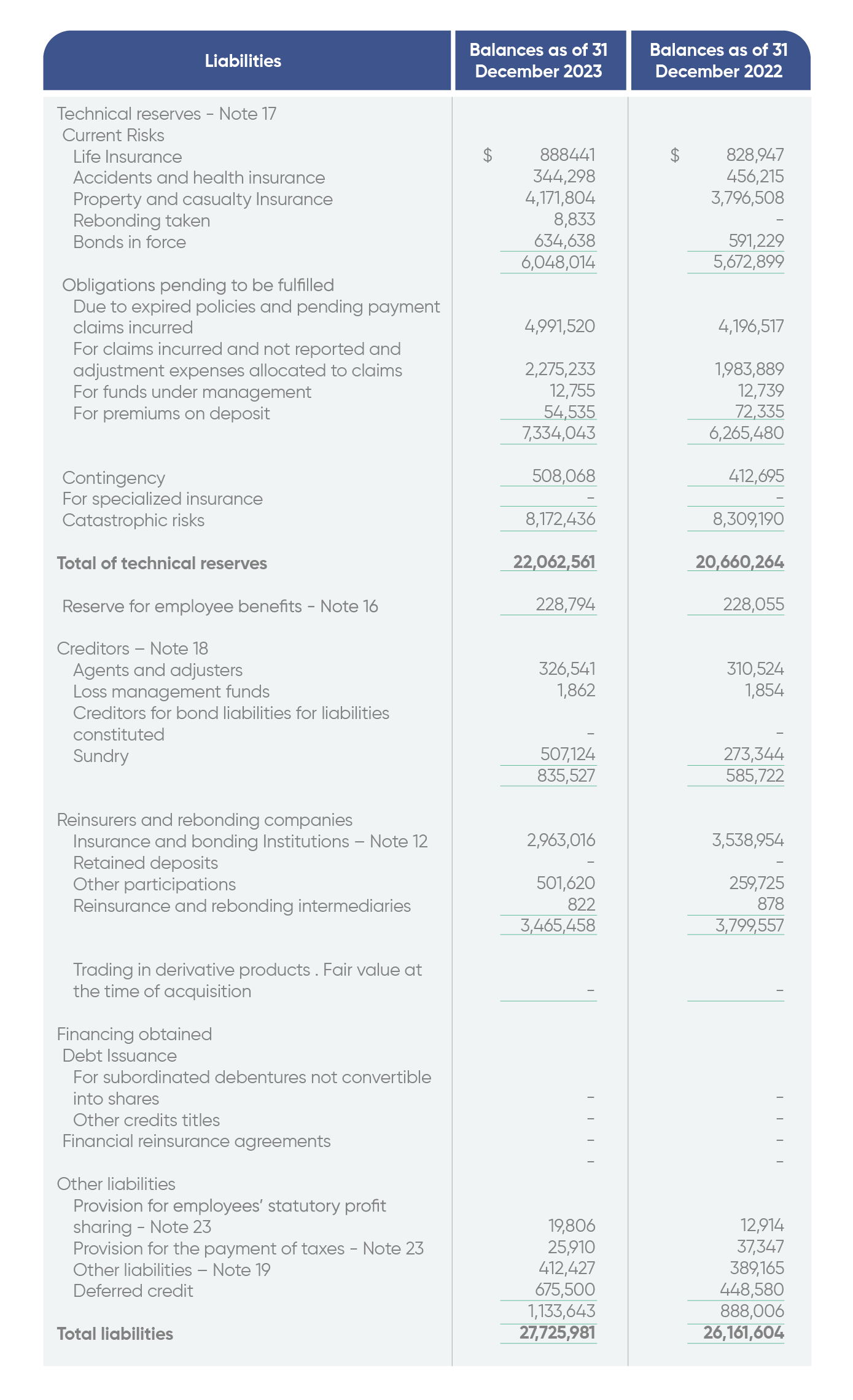

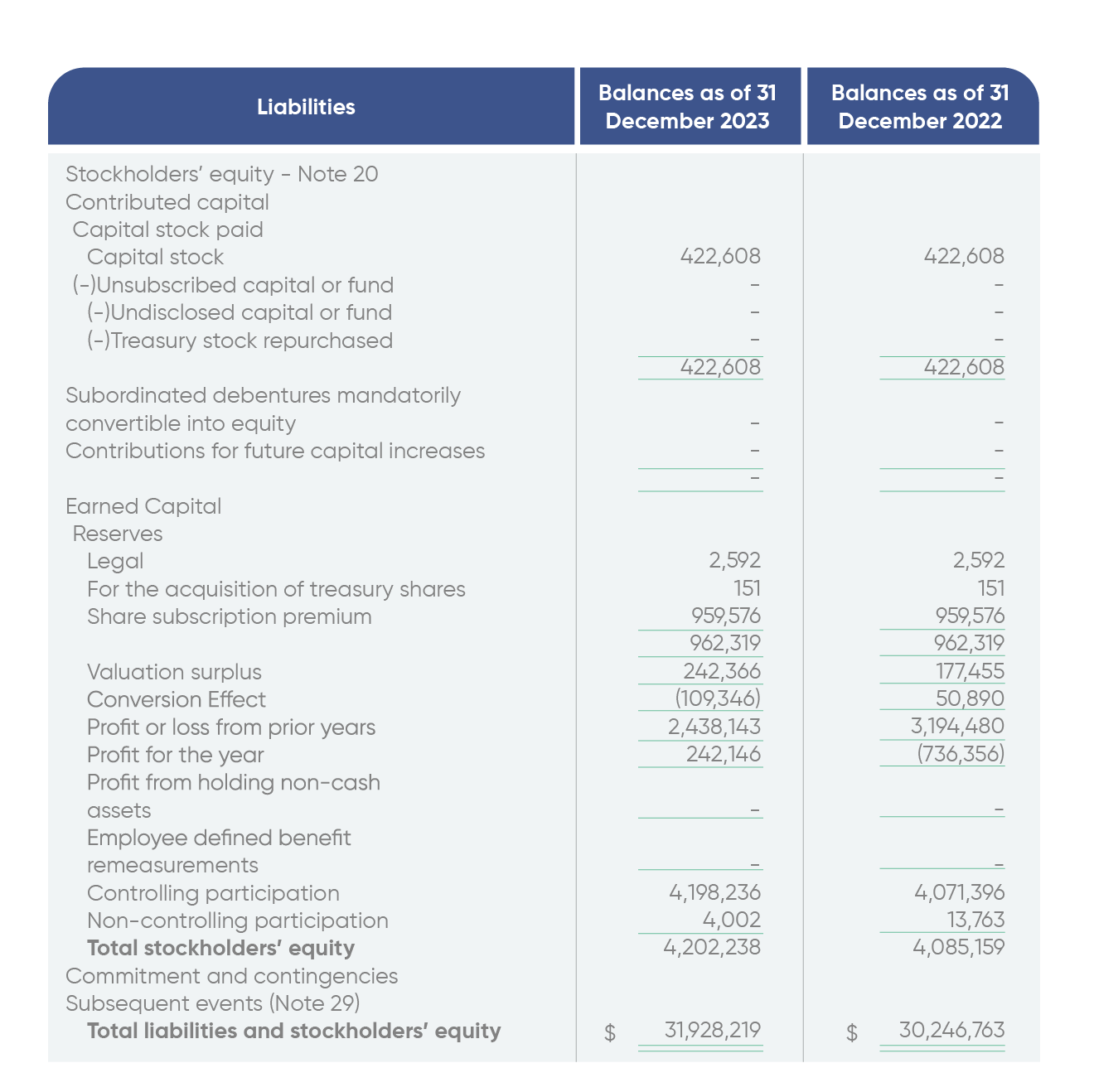

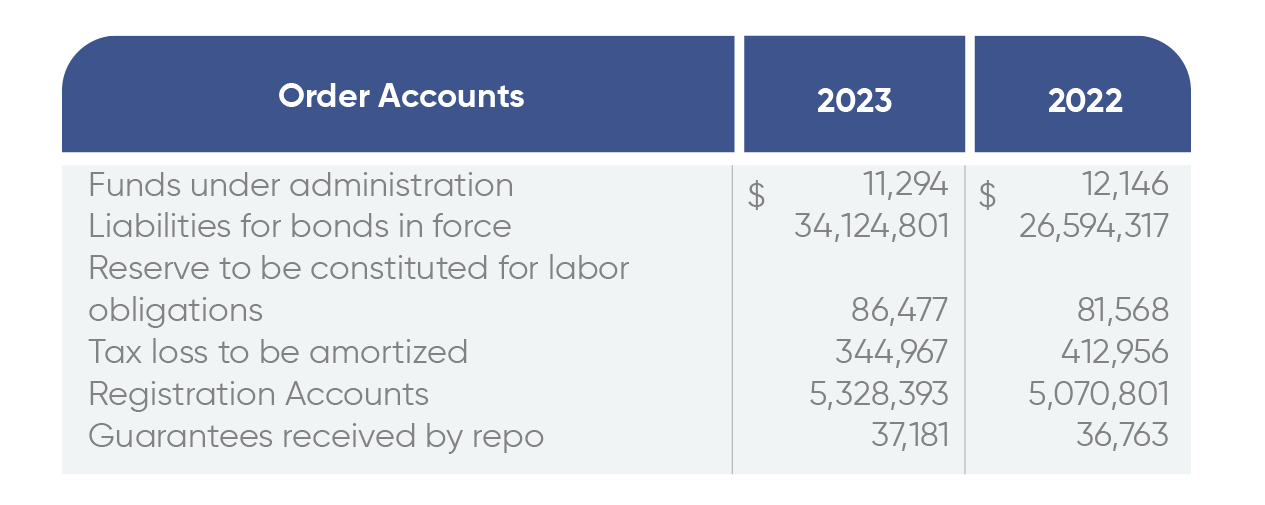

Peña Verde. S.A.B and subsidiaries

CONSOLIDATED

BALANCE SHEETS

December 31, 2023 and 2022

Figures in thousands of Mexican pesos (Note 4)

The 30 notes attached are an integral part of these financial statements.

These consolidated balance sheets were prepared in accordance with the accounting provisions issued by the National Insurance and Bonding Commission, applied consistently, and correctly reflected, as a whole, the operations carried out by the Institution and its subsidiaries as of the above-mentioned dates, such transactions were performed and valued in accordance with best institutional practices, including legal and administrative practices.

These consolidated balance sheets were approved by the Board of Directors under the responsibility of the undersigned officers.

Manuel Santiago

Escobedo Conover

Chief Executive Officer

Andrés Hernando Millán Drews

Vice President, Asset Management and Financial Strategy

Marco Antonio Campos Escalona

Deputy Director of Administration and Finance

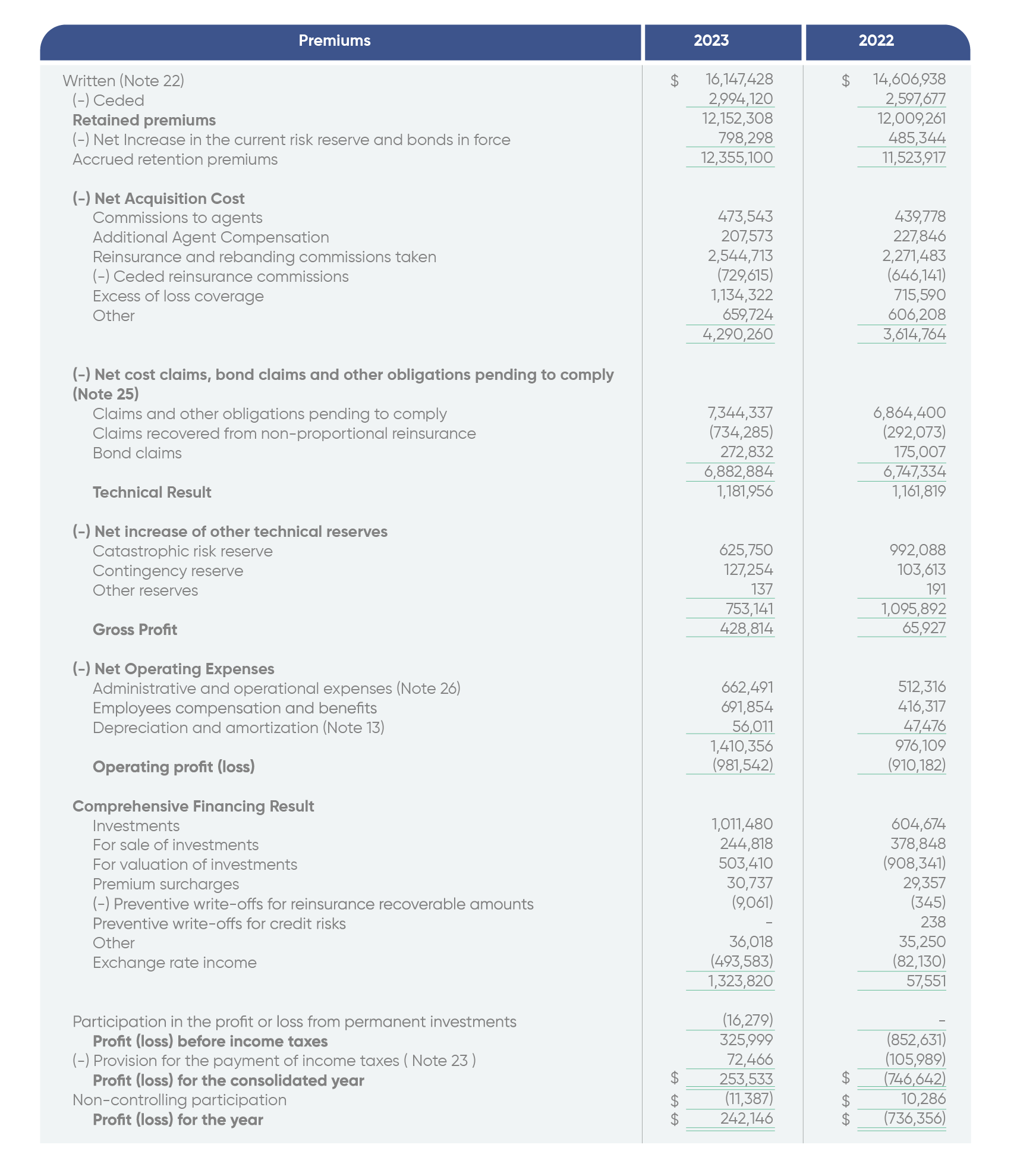

Peña Verde. S.A.B and subsidiaries

CONSOLIDATED INCOME

STATEMENTS

December 31, 2023 and 2022

Figures in thousands of Mexican pesos (Note 4)

The 30 notes attached are an integral part of the financial statements.

These consolidated income statements were prepared in accordance with the accounting provisions issued by the National Insurance and Bonding Commission, applied consistently, and all income and expenses derived from the from the operations carried out by the institution and its subsidiaries for the periods mentioned above , which were carried and valued in accordance with sound institutional practices and the applicable legal and administrative practices.

These consolidated income statements were approved by the Board of Directors under the responsibility of the undersigned officers.

Manuel Santiago

Escobedo Conover

Chief Executive Officer

Andrés Hernando Millán Drews

Vice President, Asset Management and

Financial Strategy

Marco Antonio Campos Escalona

Deputy Director of Administration and Finance

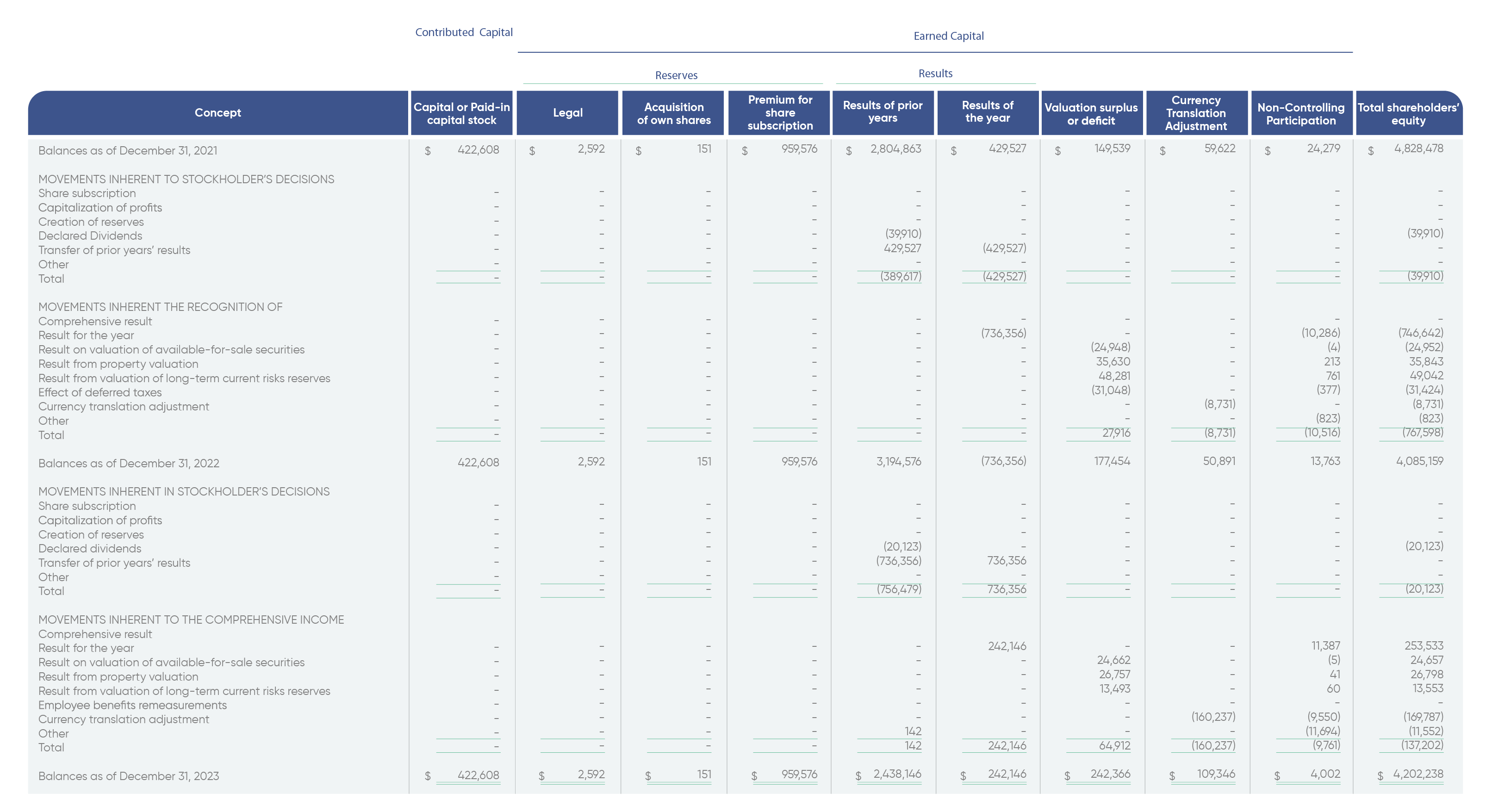

Peña Verde. S.A.B and subsidiaries

CONSOLIDATED STATEMENTS OF CHANGES

IN STOCKHOLDERS’ EQUITY

December 31, 2023 and 2022

Figures in thousands of Mexican pesos (Note 4)

The 30 notes attached are an integral part of these financial statements.

These consolidated statements of changes in stockholders’ equity were prepared in accordance with the accounting provisions issued by the National Insurance and Bonding Commission, , applied consistently, and all movements in the stockholders’ equity accounts derived from the operations carried out by the Institution and its subsidiaries for the periods mentioned above are reflected. These were carried out and evaluated in accordance with sound institutional practices and applicable legal and administrative provisions.

These consolidated statements of changes in stockholders’ equity were approved by the Board of Directors under the responsibility of the officers who signed them.

Manuel Santiago Escobedo Conover

Chief Executive Officer

Andrés Hernando Millán Drews

Vice President, Asset Management and

EFinancial Strategy

Marco Antonio Campos Escalona

Deputy Director of Administration and Finance

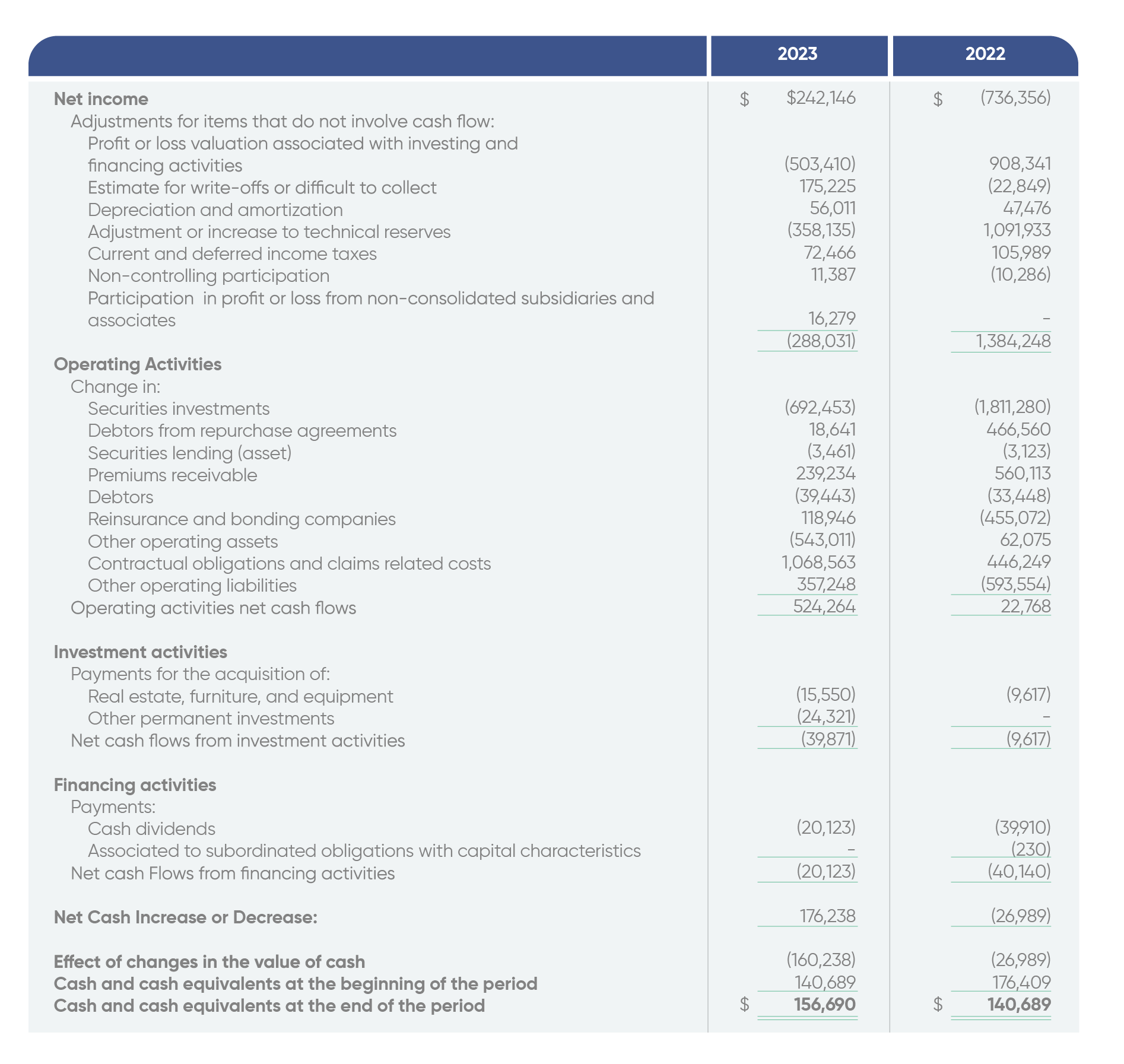

Peña Verde. S.A.B and subsidiaries

CONSOLIDATED STATEMENTS

OF CASH FLOWS

December 31, 2023, and 2022

Figures in thousands of Mexican pesos (Note 4)

The 30 notes attached are an integral part of these financial statements.

These consolidated cash flow statements were prepared in accordance with the accounting provisions issued by the National Insurance and Bonding Commission, applied consistently, reflecting all cash inflows and outflows that occurred in the Institution and its subsidiaries for the periods mentioned above , such transactions were performed and valued in accordance with best institutional practices, including legal and administrative practices.

These consolidated statements of cash flows were approved by the Board of Directors under the responsibility of the officers who sign them.

Manuel Santiago Escobedo Conover

Chief Executive Officer

Andrés Hernando Millán Drews

Vice President, Asset Management and

Financial Strategy

Marco Antonio Campos Escalona

Deputy Director of Administration and Finance