OUR OPERATIONS

OUR OPERATION

Insurance Unit

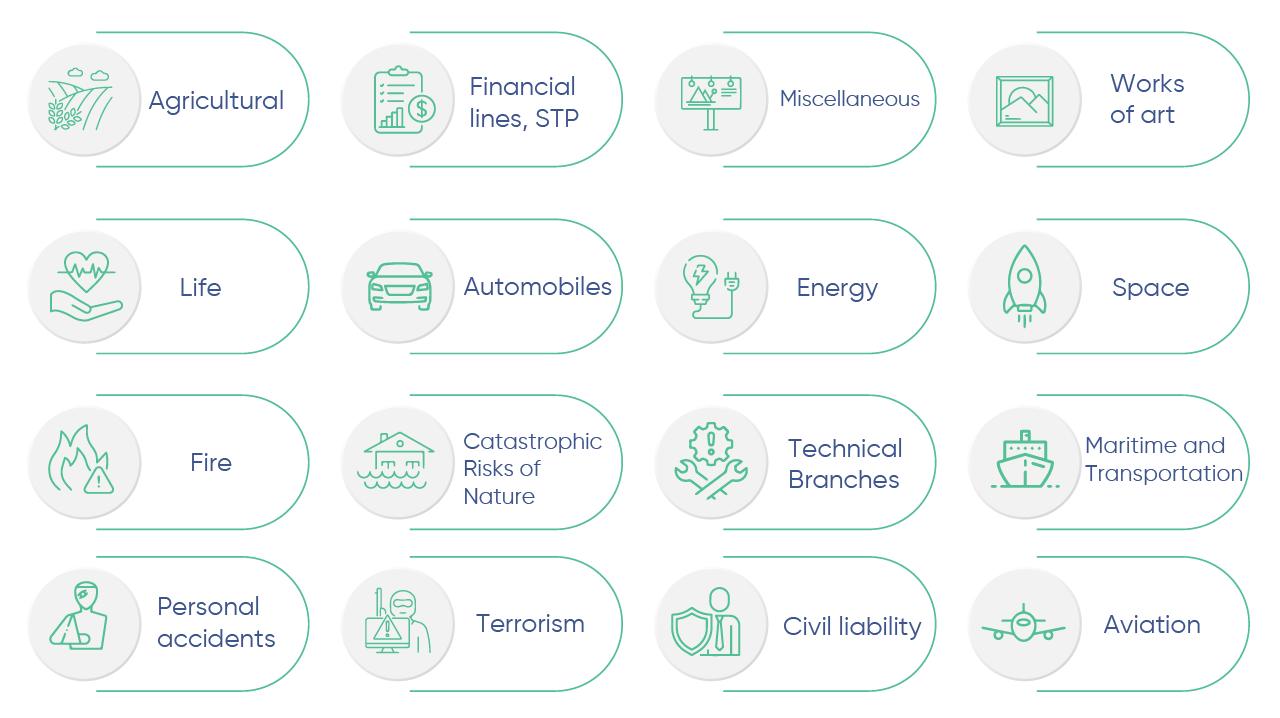

Through General de Seguros, we offer a wide range of coverages covering different areas, such as life, personal accident, liability, fire, earthquake, catastrophic risks, as well as agricultural, animal, marine, transportation, automobile, and more. These coverages are distributed through an extensive network of 2,550 insurance agents. These agents, being independent individuals, receive compensation based on commissions, rewards and incentives that are linked to the achievement of their sales objectives. Also, part of the sales process is carried out through brokers.

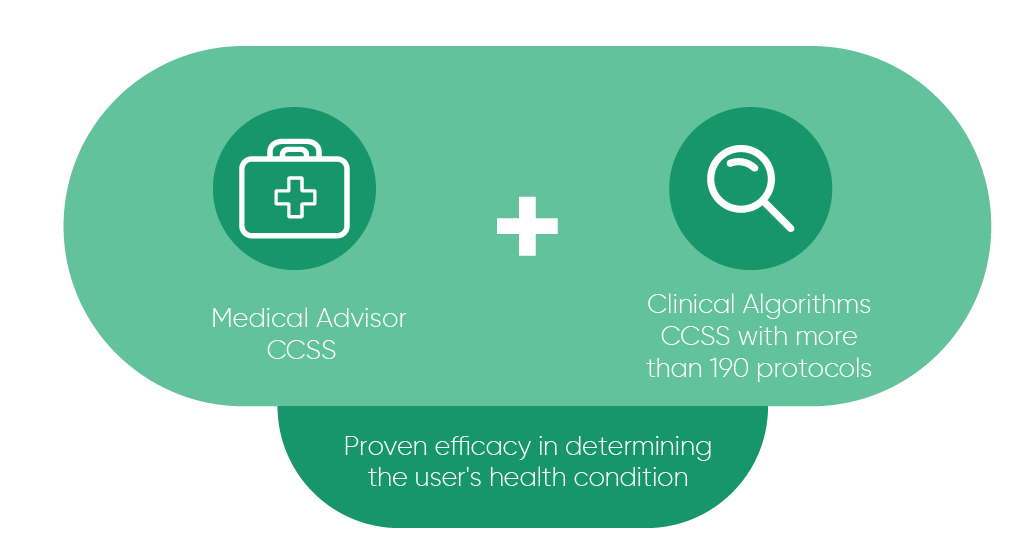

Through General de Salud, a subsidiary of General de Seguros, we offer health and medical expense coverage. These coverages are complemented by the services of the CCSS (Centro de Contacto de Servicios de Salud), which provides telephonic medical guidance to policyholders. This results in direct savings in health services, greater operational efficiency and high user satisfaction and confidence in the service.

TRADEMARKS OF GENERAL DE SEGUROS

During 2023, by virtue of its 50th anniversary and its transformation process, General Insurance evolved from a “detect and repair” to a “predict and prevent” stance, with the goal of being a close partner of customers from now on in the risk reduction process.

Reinsurance Unit

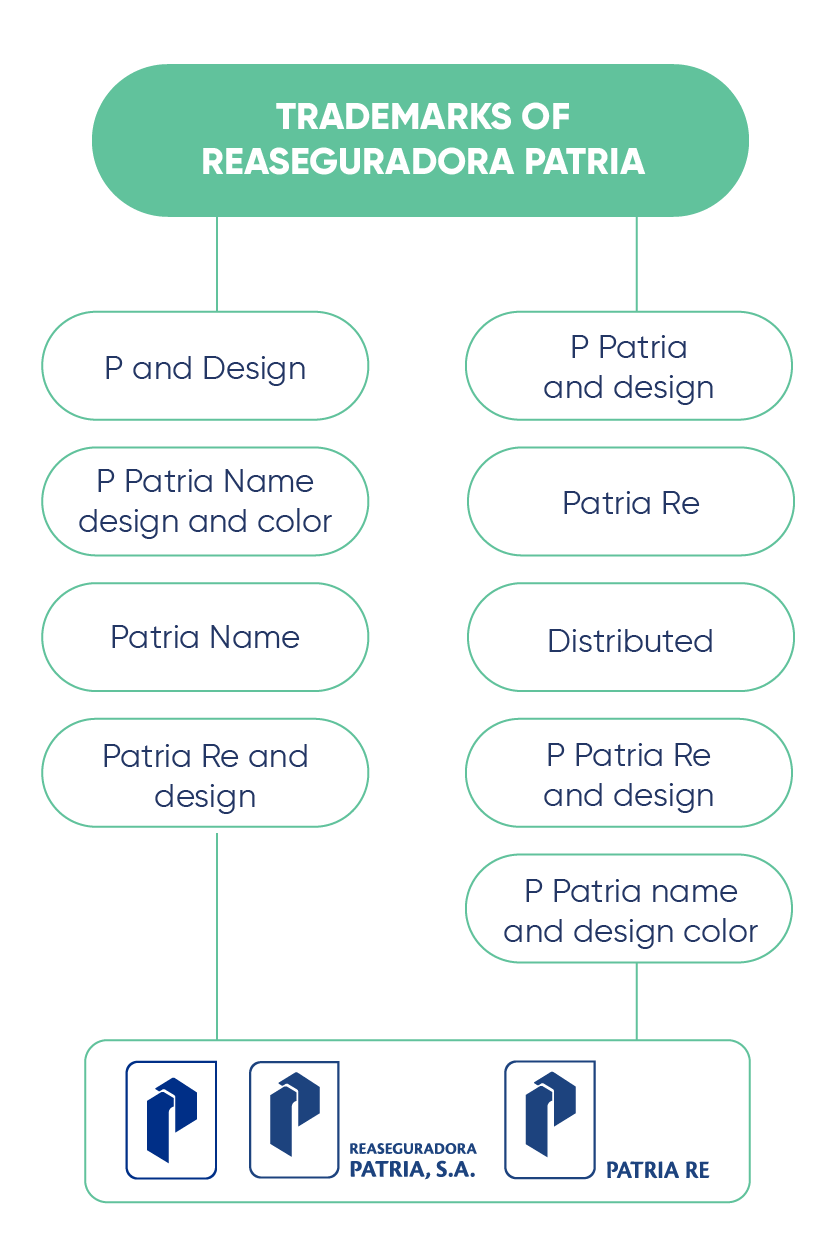

Authorized by the National Insurance and Bonding Commission, Reaseguradora Patria carries out various reinsurance and reinsurance activities. These activities are negotiated both directly and through reinsurance intermediaries with domestic and foreign insurance and reinsurance institutions.

Peña Verde

Simultaneously with risk management, which is the primary focus of Peña Verde, S.A.B., the company is engaged in the acquisition of shares or participations in companies of all kinds, both domestic and foreign. In addition, it offers a wide variety of services, either on its own behalf or on behalf of third parties, including administrative, accounting, advisory, commercial, financial and operational activities.

Our Clients

No single client of General de Seguros and Reaseguradora Patria accounts for more than 5% of total premiums written. This is due to the considerable variety in the sale of products in the insurance sector and the diversification strategies applied by Grupo Peña Verde in the reinsurance field.

GEOGRAPHICAL FOOTPRINT

By the end of 2023, Grupo Peña Verde’s international presence includes Mexico, Chile, the United Kingdom and the United States

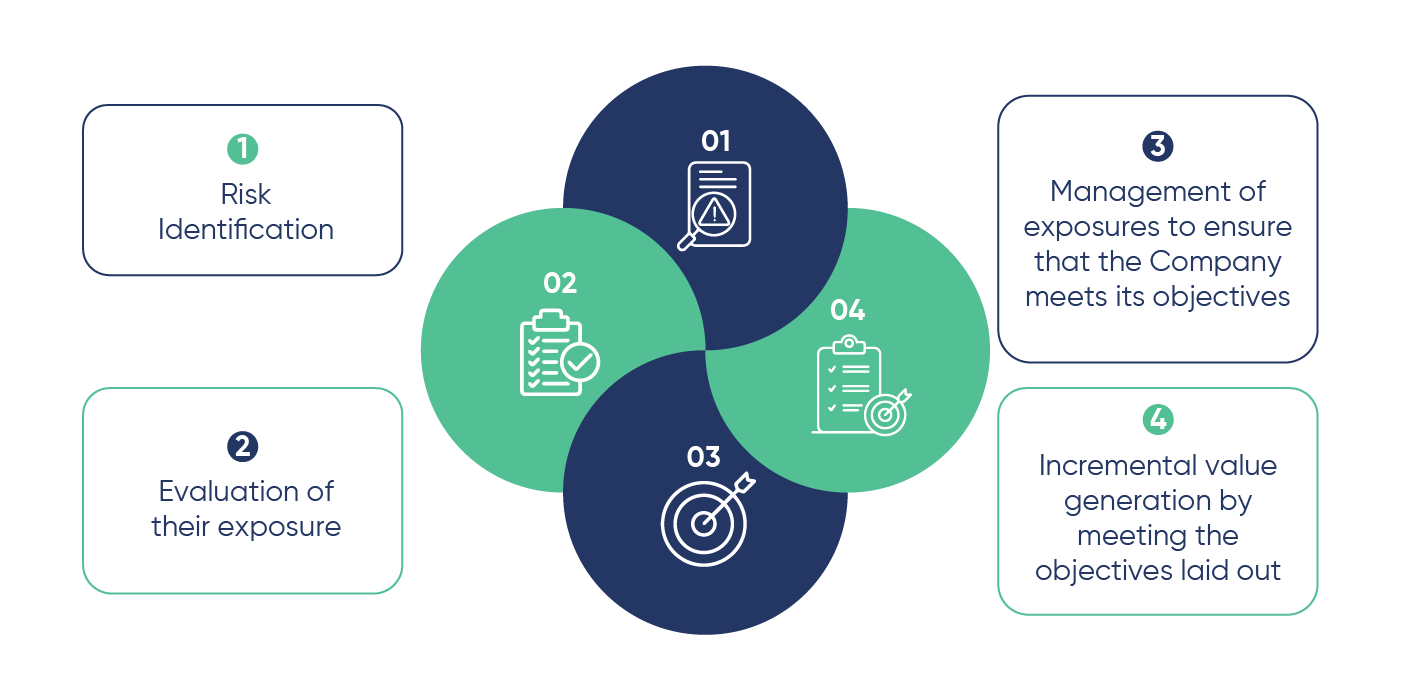

RISK MANAGEMENT

Within the framework of its Corporate Governance, Grupo Peña Verde has implemented a Comprehensive Risk Management System in order to maintain the necessary flexibility to anticipate emerging risks that could impact its operations, considering its participation in the Insurance and Reinsurance areas. This system encompasses the essential objectives, policies and procedures for comprehensive risk management, aligned with Grupo Peña Verde’s business plans. It also includes the fundamental processes and procedures to supervise, manage, measure, control, mitigate and report on an ongoing basis on the risks, both external and internal, to which the Group may be exposed, both individually and in the aggregate.

Comprehensive Risk Management:

In order to carry out this crucial task, the Risk Committees of all the companies belonging to the Group meet on a monthly basis. During these meetings, they submit reports on the status of risks to the General Management and the Board of Directors, who are responsible for defining the actions to be taken in this regard. It is also imperative to maintain optimal communication with:

- Risk owners (underwriting, investments, operations, etc.);

- The areas in charge of event detection, mitigation or prevention (administration, reinsurance, systems, etc.) and;

- Authorities (regulatory, academic or expert) that may introduce new treatments for existing risks or even discover new risks.

For this system to work properly, the participation of all employees is necessary. For this reason, as part of the onboarding process, training is provided to learn about the different ways in which employees participate in this system, and together we promote an effective risk culture.

Likewise, there are mechanisms for periodic communication of risks between the areas as well as collaboration in the qualitative and quantitative analysis of risks for new products, businesses, investments or strategies proposed in the Group.

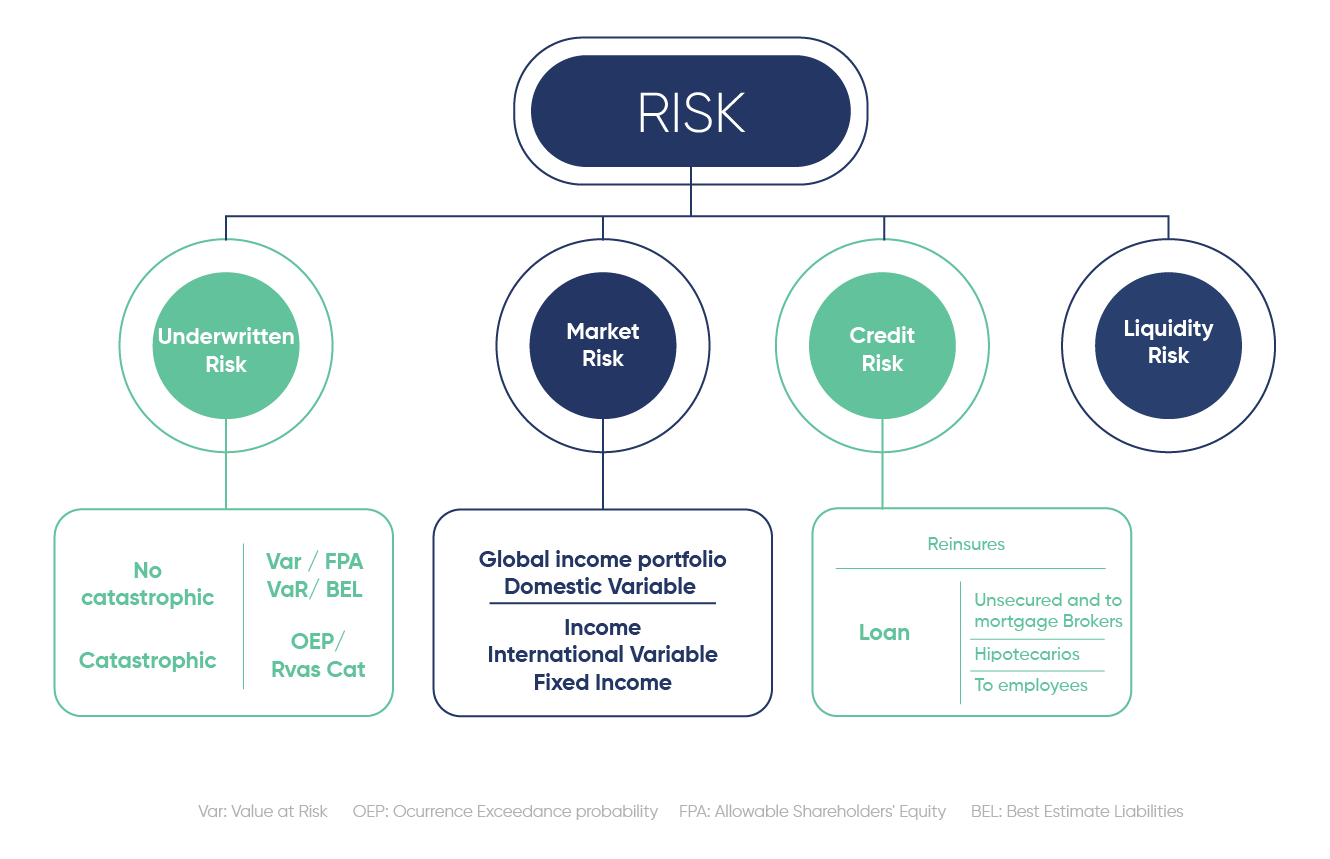

Although we have identified the various risks to which both the Group as a whole and its subsidiaries are exposed, it is considered highly unlikely that all of them will occur simultaneously, due to the correlation between them. For this reason, Grupo Peña Verde classifies these risks according to their potential impact, as presented below:

In order to ensure sound risk management, each Company’s Board of Directors has set exposure limits for the following risks:

It is crucial to highlight that there are emerging risks with a high degree of uncertainty, capable of causing losses that are difficult to quantify accurately. These eventualities could threaten the Company’s solvency and/or compromise the achievement of its business plan, should they materialize. For this reason, Grupo Peña Verde takes all appropriate measures to mitigate as much as possible any potential impact.

In this context, by identifying emerging risks such as climate change, the Company has made considerable efforts to incorporate best practices in environmental and social terms, aspiring to stand out as a benchmark in aspects such as Human Rights, Labor Standards, Environment and the fight against corruption. For this reason, since October 2020, the Group has actively participated in the main corporate sustainability initiative worldwide: the United Nations Global Compact.

In addition, beginning in 2022 Grupo Peña implemented a new measurement methodology and quantification of its operational risks according to a standard risk taxonomy which complies

with risk management based on ISO 31000; with this the Company expects to strengthen the visibility and monitoring of indicators that help mitigate and manage the operational risks of the institutions that make up the Group.

On the other hand, quantitative regulatory analyses are proposed, such as the Dynamic Solvency Test, which identifies possible deviations in premiums, loss ratio, costs and financial product, caused by external phenomena such as an increase in catastrophic events, so that risks, opportunities and mitigation measures can be identified.

INTERNAL COMPLIANCE

During 2023, as a result of the transformation that Grupo Peña Verde is undergoing, new ways of obtaining competitive advantages and making processes more efficient were sought. In addition, in response to the Audit Committee’s request to strengthen the Internal Control area, contributing to the strengthening of Corporate Governance and the Internal Control System, the Corporate Internal Control Department was created to:

Improve the Company’s processes through the establishment of controls and alignment with business risks; and,

Establish formal monitoring mechanisms for the resolution of deviations in the functioning of the Internal Control System, as well as the homologation of COSO & COBIT5 methodologies at Group level.

During 2023, we continued with the process of continuous improvement through the redesign of processes and the issuance of corporate policies and procedures applicable to all the companies of the Peña Verde Group, aimed at strengthening the control environment in them. Among the main activities carried out by the General Management as responsible for the Internal Control System, the Internal Control function was consolidated at the corporate level through the Internal Control Department, which was delegated the function of carrying out the Internal Control evaluations, as well as following up on the progress of the implementation of the Remediation Plans. Finally, we participated in the main strategic initiatives that Grupo Peña Verde executed during fiscal year 2023.

GENERAL DE

SEGUROS

As part of General de Seguros’ strategy to establish a Corporate Governance framework and in compliance with the work plan, these are the important processes that were implemented during fiscal year 2023, to collaborate in strengthening internal control in the Issuer:

- The progress in the implementation of the Remediation Plans was followed up as a result of the evaluation of the Internal Control of the processes of: Claims, Collection, Payroll Deduction and Bonuses & Commissions.

- Design and implementation of a work plan to perform walkthroughs in the critical processes corresponding to General de Seguros for fiscal year 2024, carrying out the identification of risks and controls.

- Participation in the company’s main initiatives during 2023, with the objective of carrying out the identification of controls, in addition to validating their regulatory compliance related to General de Seguros, such as the implementation of the new Core system.

In the case of Reaseguradora Patria, a redesign of administrative processes is being carried out in order to make the operation more efficient, seeking to strengthen the control environment. This redesign will also involve the establishment of operational efficiency and control indicators, which will make it possible to monitor deviations and take timely action. These are the important processes that were implemented during fiscal year 2023, to collaborate in strengthening internal control in the Issuer:

- The progress in the implementation of the Remediation Plans was followed up as a result of the Internal Control evaluation of the following processes: Technical Administration, Commissions and Finance.

- Design and implementation of a work plan for the implementation of walkthroughs in the core processes of Reaseguradora Patria for fiscal year 2024, carrying out the identification of risks and controls.

INTERNAL CONTROL AT

THE CORPORATE LEVEL

As part of Grupo Peña Verde’s strategy to establish a Corporate Governance framework and in compliance with the work plan, these are the important processes that were implemented during fiscal year 2023, to collaborate in the strengthening of internal control in the Issuer:

- Evaluation of the Internal Control of the corporate processes supporting the subsidiaries of: Shared Center, Project Management, Information Technology and Human Resources. The reviews were carried out based on the COSO control framework (Risk Based Control Framework) & COBIT 5 (IT Governance), in addition to the compliance review based on the provisions established in the LISF, LFPDPPP, CUSF, etc., identifying risks and controls.

- The progress in the implementation of the Remediation Plans was monitored as a result of the evaluation of the Internal Control of the following processes: Shared Center and Project Management: Shared Center and Project Management.

BUSINESS MODEL

AND STRATEGY

BUSINESS MODEL

The approach of our business model can be analyzed from two perspectives

complementary to each other, which are:

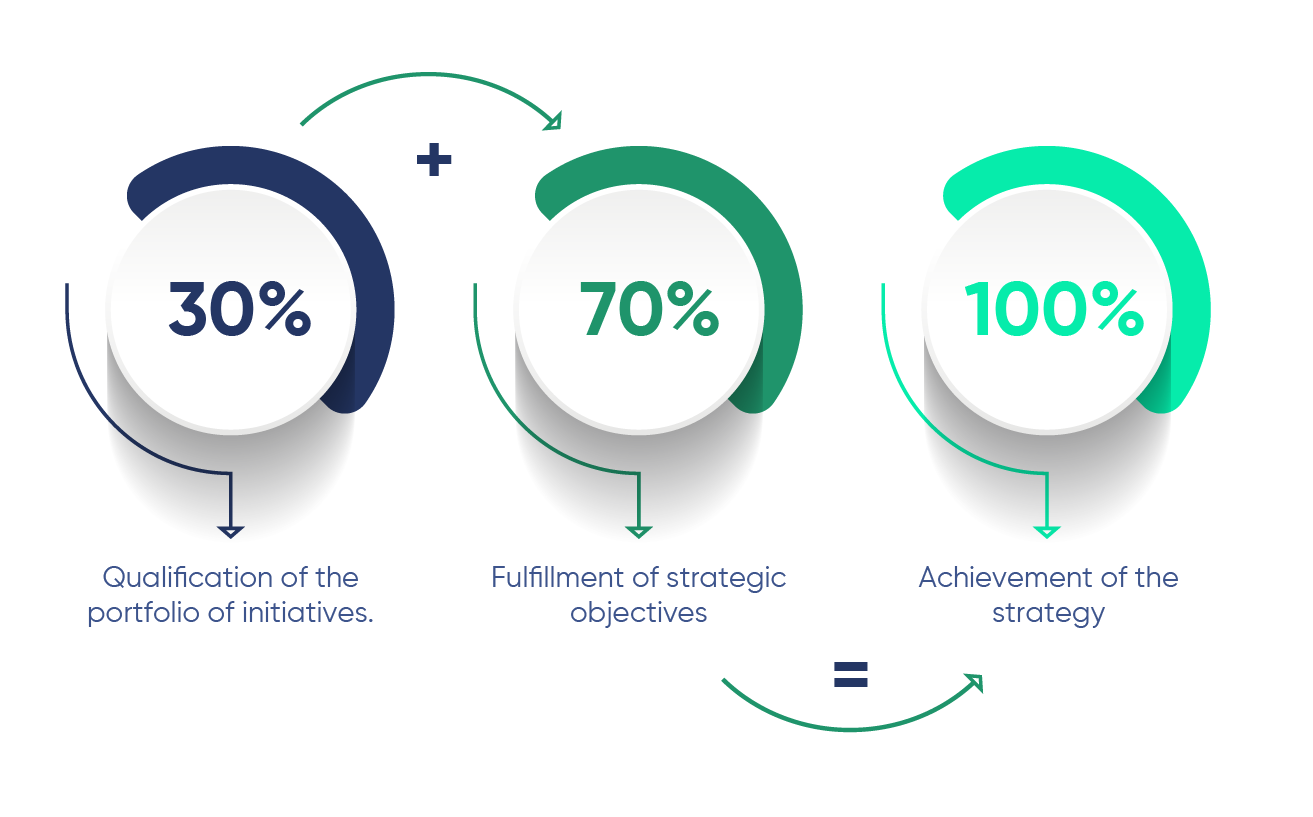

ANNUAL EVALUATION OF STRATEGY EXECUTION

In order to analyze the impact of the

implementation of our strategy at the executive

level, we have created the Strategy Achievement

indicator. This indicator specifically quantifies the

two main elements that make up its monitoring:

- Qualification of the portfolio of initiatives:

In 2023 we automated the process of evaluating the portfolio of initiatives; we now have a management tool: KPTAL, which allows us to monitor online the status of each initiative in its basic components (progress on plan, main milestones and key actions, changes, budget execution, risks and their mitigation plans) and automatically generates the rating for each initiative and for the portfolio as a whole, the latter corresponding to the average of all the initiatives executed during the period.

- Fulfillment of strategic objectives:

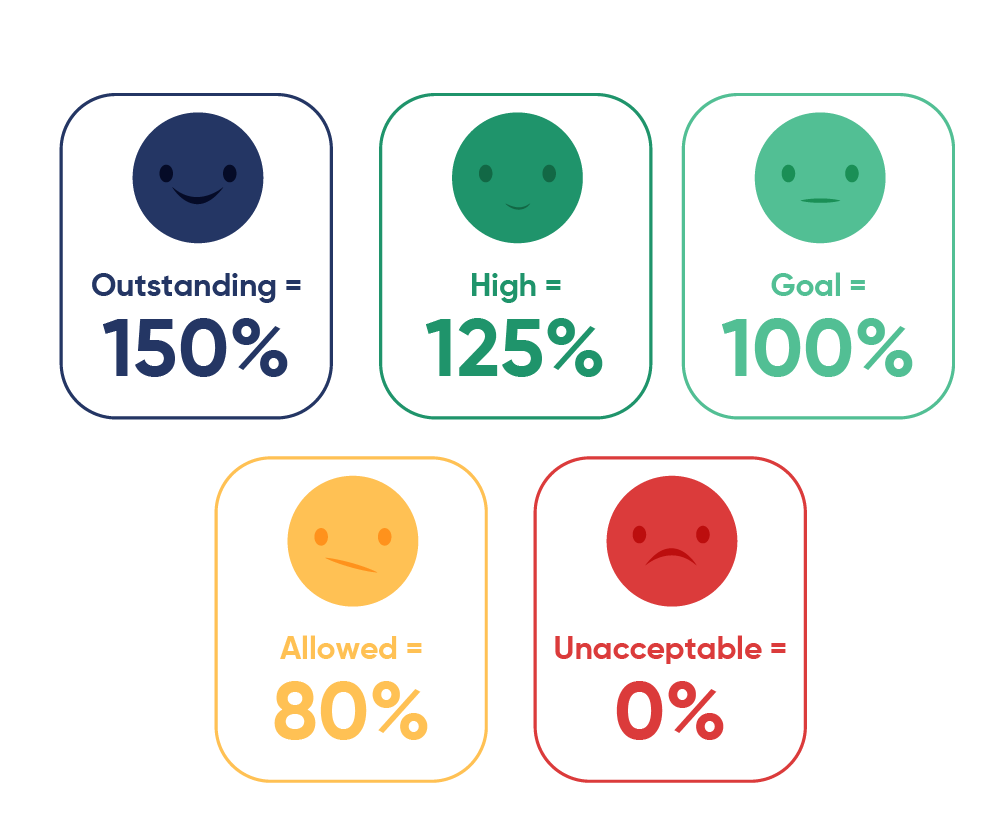

This involves the evaluation of the achievement of key indicators associated with the strategic objectives, using a scale that ranges from 0% to 150% and contemplates five performance levels:

The rating of the strategic objectives is determined by taking the average of the compliance achieved in the key indicators evaluated.

The metric, Strategy Achievement, is calculated as a weighted average that includes the evaluations of the previously mentioned components. A value is assigned on a scale from 0% to 100%, where “0%” reflects the minimum level of compliance and “100%” indicates the maximum degree of compliance.

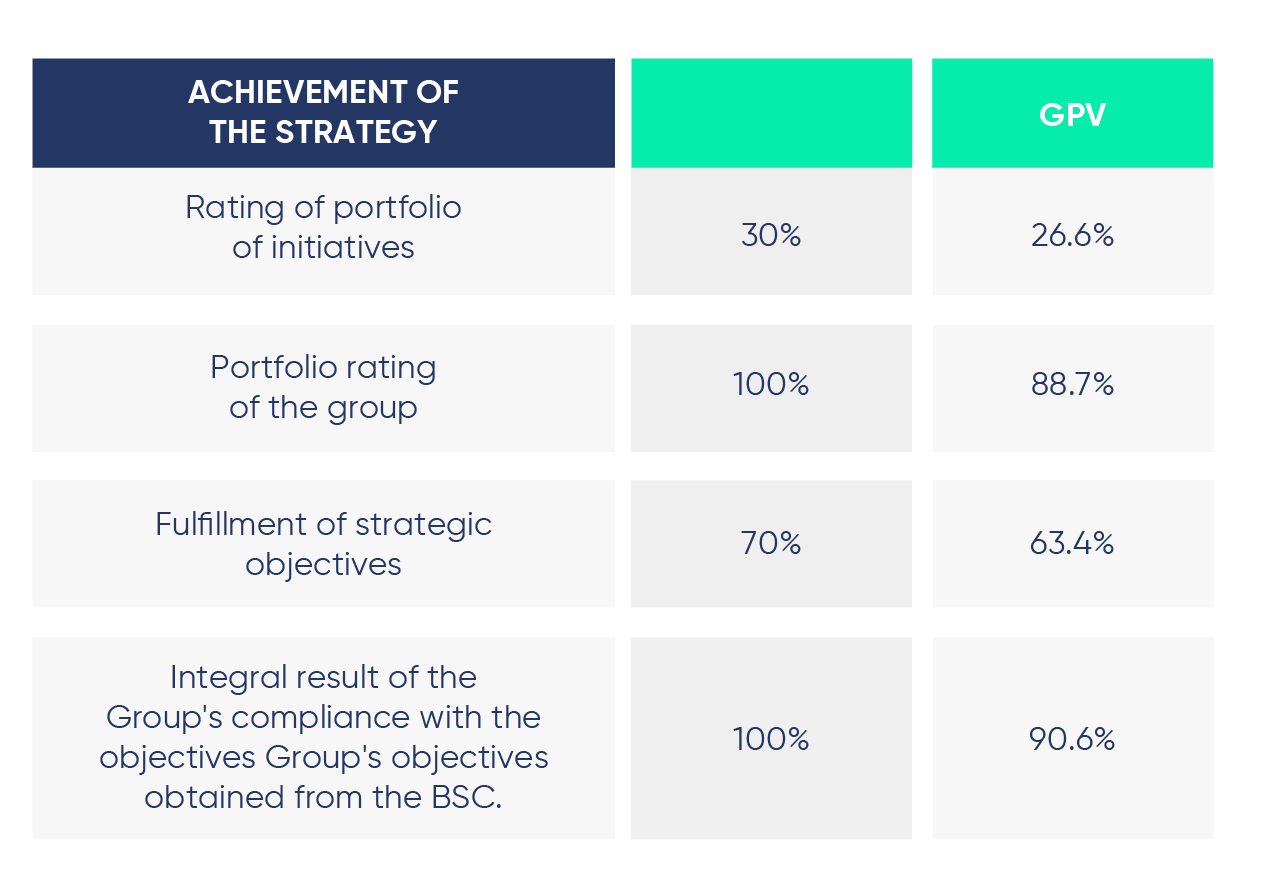

RESULTS OF THE 2023 EVALUATION

2027 SPECIFIC OBJECTIVES - INSURANCE DIVISION

OBJECTIVE >Our objective is to establish an insurance company that is solid from both a technical and operational perspective. In this way, we will be able to support the objectives of the Peña Verde Group by managing risks effectively and generating value in the process.

Transformation of the service model

Our goal is to make General de Seguros and General de Salud a recognized leader in service and innovation. We seek to build trust by providing quality, cost-effective solutions while making a significant impact on the industry.

TARGET SEGMENT >SMEs and individual insurances with simple “retail” products Strategic lines - Customer experience and channels - New operational capabilities.

STRATEGIC INITIATIVES >Growth Strategy VEHICLES AND DAMAGE

Growth Strategy LIFE & HEALTH

AGRO growth strategy

WHAT DO WE EXPECT FROM THIS UNIT?- Premiums Issued: Exceed Ps.9,112 million in 2027

- Index Combined: Reach levels of around 90%.

- Profit for the year: To achieve a profit of fiscal year > Ps.605 million in 2027

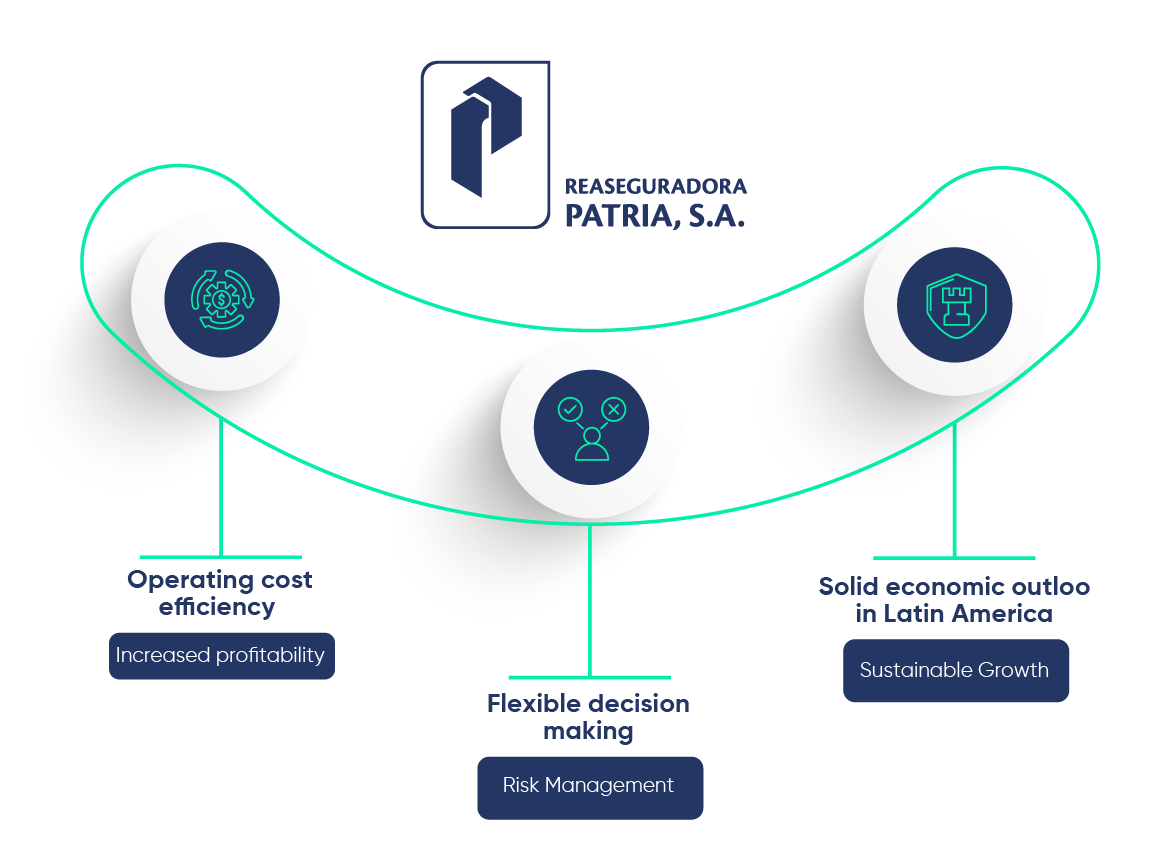

REINSURANCE DIVISION STRATEGIC PLAN FOR 2027

STRATEGIC GUIDELINES TO 2027

We seek to effectively manage growth by expanding the reinsurance practice within the Group. This will be achieved through geographic diversification and the addition of new specialty lines. At the same time, we are committed to staying true to underwriting rules and values, while developing more efficient analytical and risk management tools.

WHAT DO WE EXPECT FROM THIS UNIT?- Premiums Issued: Exceed Ps.19,199 million in 2027

- Combined Index: To be below the barrier of the 90%

- Profit for the fiscal year: To achieve a profit for the fiscal year > Ps.1,241 million in 2027

Strategic levers

- Revenue growth with profitability

- Create a resilient company.

- To guarantee a quality service both in sales and aftersales.

- Exposure control and corporate governance.

- Talent retention and attraction.

- Premiums Issued: Exceed Ps.27,974 million in 2027

- Combined Index: To be below the 90% barrier

- Profit for the Year: Achieve profit for the year > Ps.1,979 million in 2027