CORPORATE GOVERNANACE

CORPORATE

STRUCTURE

In 2012, we initiated the formation of this structure by conducting takeover bids through the exchange of shares, with the objective of establishing ourselves as the controlling company of General de Seguros, S.A. and Reaseguradora Patria, S.A.

In October 2012, with the objective of raising our different business areas to a higher level in terms of competitiveness, we created Servicios Administrativos Peña Verde, S.A. de C.V. This entity is oriented to establish a participative and innovative organizational culture, with the purpose of promoting an optimal organizational performance.

In 2013, we opened Patria Re Marketing Services Ltd. In London. In addition, in September 2015, we incorporated Patria Corporate Member Limited (PCM) under the laws of the United Kingdom, with the purpose of capitalizing on reinsurance opportunities in the Lloyd’s Bank PLC market. In parallel, we established Patria Re Services, S.A. in Santiago, Chile.

In 2016, we founded CCSS - Peña Verde, S.A. de C.V. to get involved in the ancillary services market linked to insurance. In addition, we opened Patria Risk Management Inc. in Miami.

Also, during 2023, in line with our group strategy and in order to expand our reinsurance operations, Patria Re (US) Inc. was created in South Carolina.

In this sense, Grupo Peña Verde is constituted as a holding company covering four different business areas:

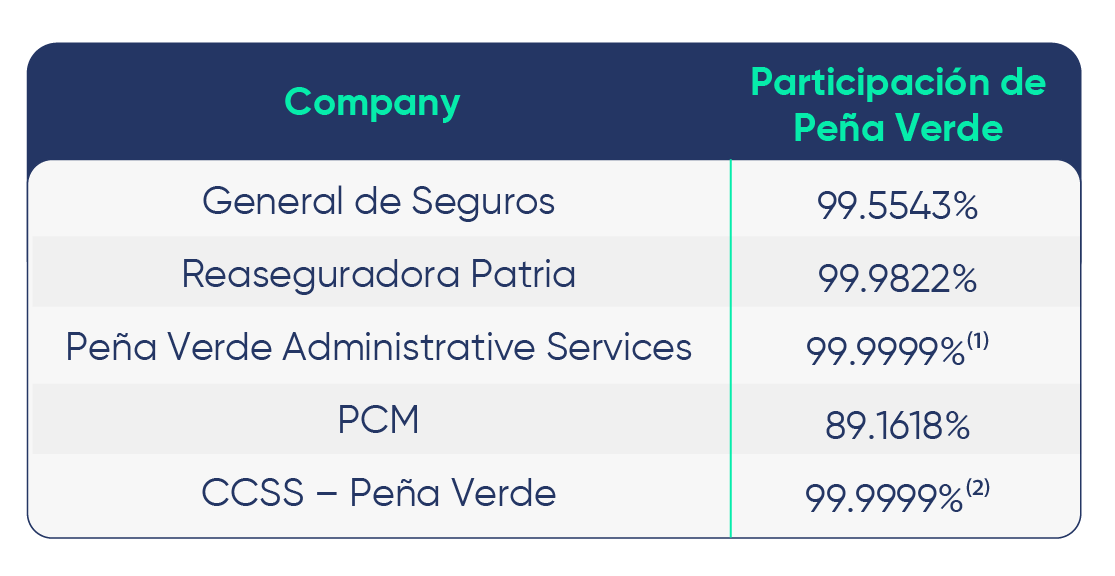

At the end of 2023, our interest in our subsidiaries is distributed as follows:

- (1) The remaining 0.0001% is owned by Reaseguradora Patria.

- (2) 0.001% is owned by Servicios Administrativos Peña Verde.

SHAREHOLDER

STRUCTURE

The capital stock of Peña Verde, S.A.B., as of December 31, 2023, amounted to a total of 642,431,282 shares of common stock, single series, common nominative and without stated par value. Of this total, 476,678,213 shares were outstanding, while 165,753,069 shares remained in treasury. It is important to note that of the 165,753,069 shares held in treasury, 9,380,700 are subscribed.

At year-end 2023, our market capitalization amounted to Ps.4,624 million, with a price of Ps.9.7 per share.

SHAREHOLDERS MEETING

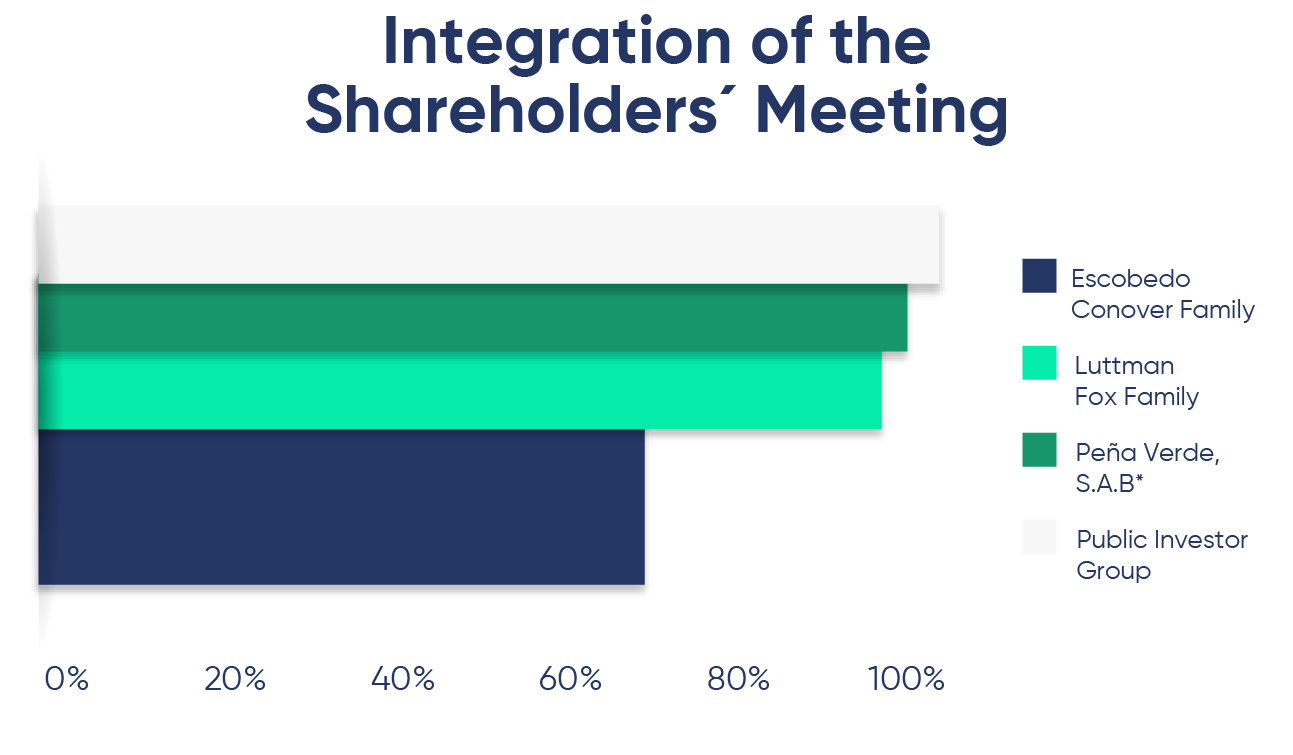

The Shareholders’ Meeting constitutes the highest governance body of the company, establishing the philosophy and risk appetite that guide business operations. It is also responsible for decision making and provides the strategy to the Board of Directors to oversee its proper implementation along the value chain.

With 66.25% of the Company’s shares, the Escobedo Conover family has a majority control in the Group. The Luttman Fox family owns an additional 30.95%, which gives them significant influence in corporate decisions. The remaining 0.84% is held by public investors, while the remaining 1.95% is held in Treasury.

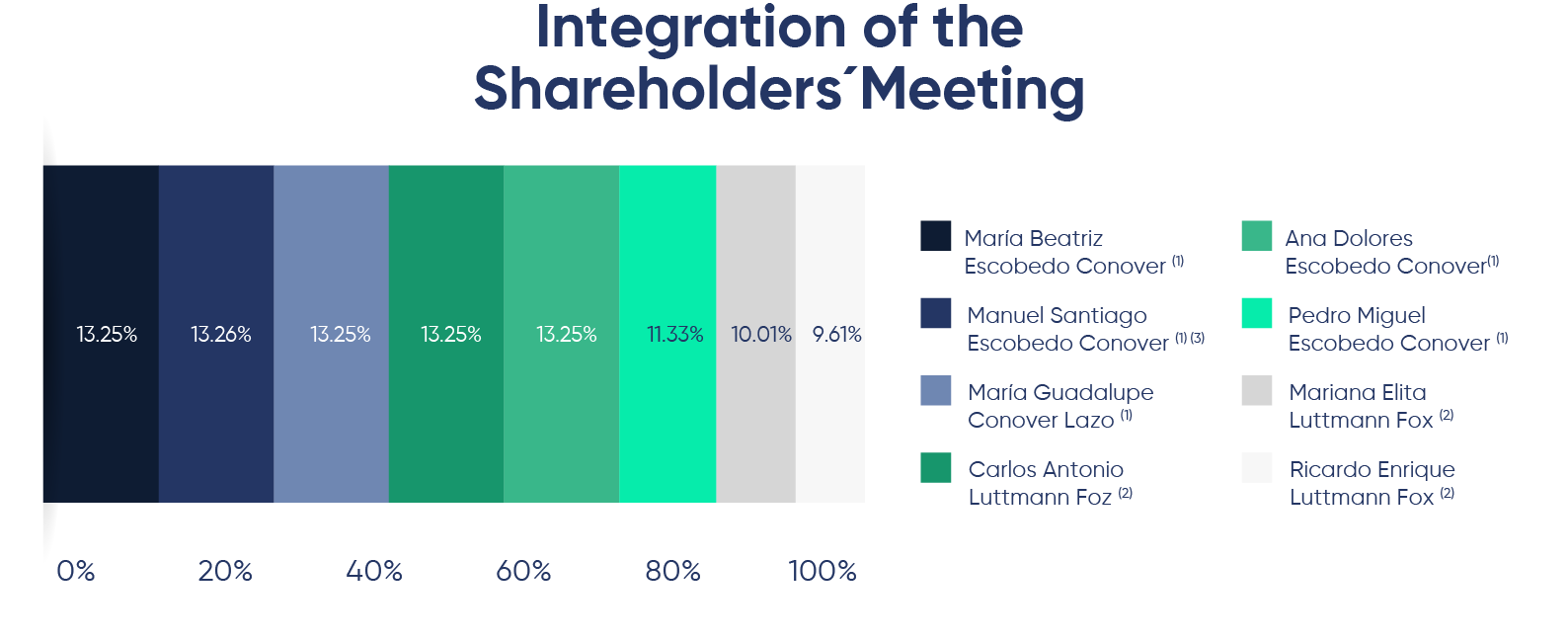

The following is the individual shareholding of the main stockholders of Peña Verde Group by the end of 2023:

- (1) Controlling shareholders

- (2) Shareholders exercising significant influence

- (3) General Manager of Grupo Peña Verde

BOARD OF

ADMINISTRATION

This material refers to contents 2-11, 2-12, 2-18, 2-23: General Contents 2021

The main objective of the Board of Directors at Grupo Peña Verde is to ensure effective management and appropriate control of corporate governance. In this sense, it is composed of visionary, efficient, strategic and proactive directors, who oversee the management, direction and execution of all the company’s operations.

To ensure the strength and effectiveness of corporate governance, directors receive annual training on economic and governance issues related to the insurance and reinsurance sector. In addition, they are provided with the necessary information on each of the subsidiaries.

At the end of each session, the Council conducts a self-evaluation of its performance by means of an operational survey. In this way, the necessary actions for improvement are identified, based on the results obtained.

In addition, with the purpose of guaranteeing an efficient operation, the Board of Directors has several Committees under its supervision. The nomination and selection of the members of both the Board and the Committees is carried out in accordance with guidelines covering various criteria, such as:

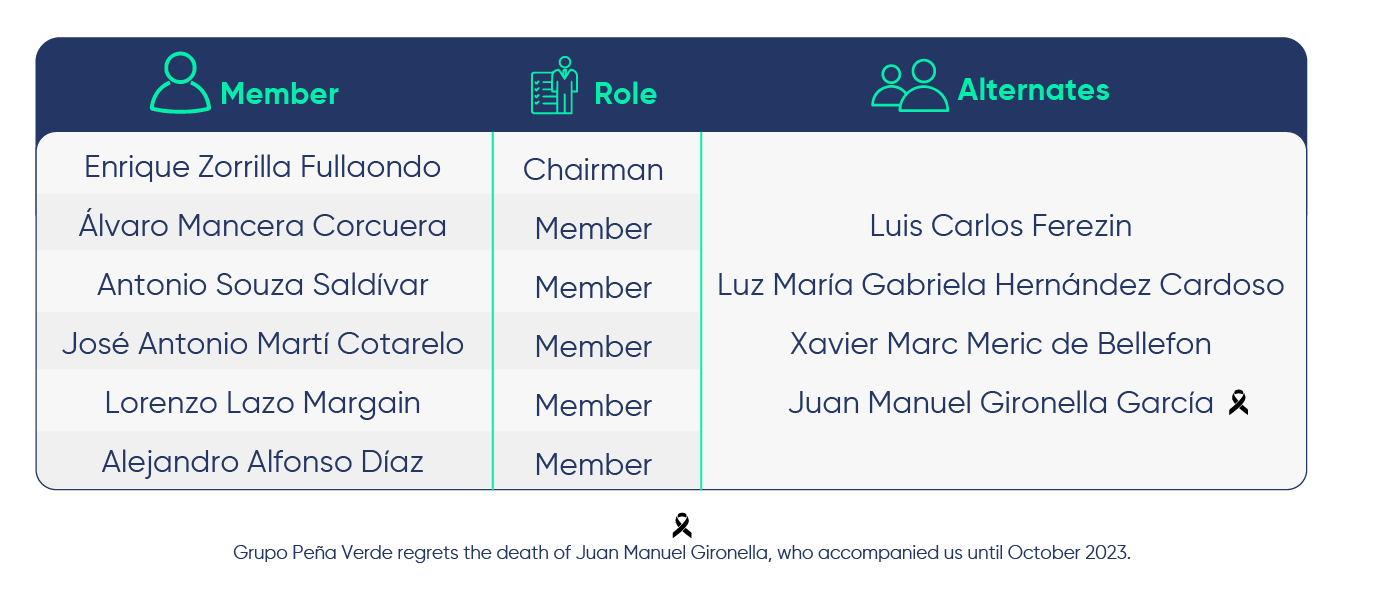

INTEGRATION OF THE

BOARD OF DIRECTORS 2023

All members of the Board of Directors, including the Chairman, qualify as independent under the standards of the Mexican Securities Market Law.

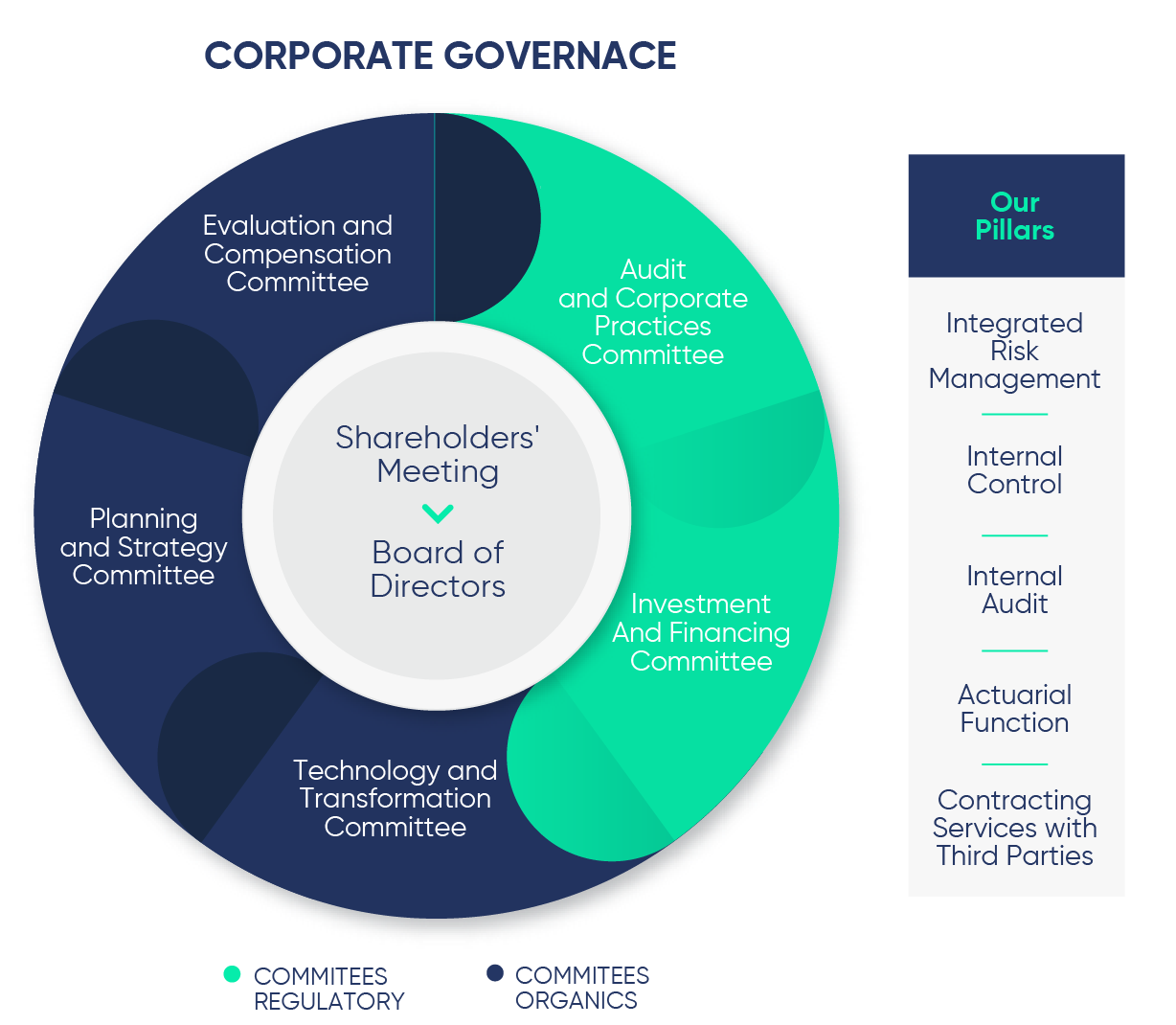

COMITTEES

This material refers to contents 2-9, 2-20 and 2-27: General Contents 2021.

In order to ensure an inclusive, participatory and representative decision-making process, Grupo Peña Verde has implemented corporate governance supported by five organic committees, two of which have regulatory functions. These committees are responsible for providing support to the Board of Directors.

We effectively execute the decisions adopted throughout the operation, thanks to the structure that enables us to meet both the needs of the Group and those of our stakeholders.

EVALUATION AND

COMPENSATION COMMITTE

PURPOSE

The Evaluation and Compensation Committee is responsible for ensuring the presence of talent and adherence to the organizational culture in the Group, especially in crucial functions such as senior management. Its goal is to foster the Company’s competitiveness through a sustainable growth approach.

PLANNING AND STRATEGY

COMITTEE

PURPOSE

It provides support to the Chairman’s Office in the procurement and expansion of the business, as well as in the implementation of efficient corporate governance and internal control.

As a consequence of the adherence of the Planning and Strategy Committee to article 69° of the Law of Insurance and Bonding Institutions (LISF, for its Spanish acronym) to establish corporate governance and internal control, policies and procedures have been developed related to:

TECHNOLOGY AND

TRANSFORMATION COMMITTEE

PURPOSE

Aiming to generate greater value for customers and shareholders, the Company implements new technologies and adopts market trends in its operating processes, carrying out a complete digitalization of the Group.

AUDIT AND CORPORATE

PRACTICES COMMITTEE

PURPOSE

Will be in charge of supervising our compliance with the internal regulations established by the Board of Directors, as well as with the applicable legal and administrative provisions. In addition, he/she will ensure that financial and operating information is disclosed in a responsible and transparent manner.

The Audit and Corporate Practices Committee supports the Board of Directors. The Company’s management team has been involved in the Internal Audit activity.

INVESTMENT AND FINANCING

COMITTEE

PURPOSE

Defines the Company’s investment policy and strategy, in accordance with current regulations and respecting the limits established by the Risk Committee, which must have the prior approval of the Board of Directors.

In addition to these five committees, Grupo Peña Verde has created two other committees for specific operational purposes, considering that their importance merits it:

FISCAL COMMITTEE

PURPOSE

The committee is responsible for ensuring full compliance of the subsidiaries with current tax laws and for analyzing initiatives and their consequences on the operation. For this reason, it is responsible for evaluating the risks associated with this area, establishing and approving all of Peña Verde S.A.B.’s tax criteria, which are standardized among the subsidiaries.

In this regard, the Tax Committee examines individually the tax risks identified in each subsidiary and prepares a group-wide criterion, establishing a supervision and follow-up framework for each subsidiary.

Two external professionals provide advice to the Tax Committee, both of whom are members of well-known firms specializing in tax matters.

SUSTAINABILITY TASK

GROUP

In order to ensure Peña Verde’s environmental, social and governance commitment, a Sustainability Working Group has been created. Its main function is to oversee that a sustainable approach is maintained in the strategy and its execution, as well as to report directly to the Planning and Strategy Committee.

ETHICS.

At Grupo Peña Verde, we have principles that are essential to the success of our business. Therefore, we adhere to our Code of Ethics and Business Conduct (the “Code”), approved by the Audit Committees and Boards of Directors of our subsidiaries. This orientation allows us to offer mainly intangible products, build, transmit and maintain trust among customers.

In this way, Grupo Peña Verde guides our daily actions according to the ethical principles aligned with our mission, vision and values of each of our subsidiaries.

This, in turn, promotes solid relationships based on respect, integrity and legality. In this regard, all contractual documentation is structured to fully ensure the human and fundamental rights of policyholders, customers, employees and all persons related to the Group and its Companies. This approach is in line with the 2011 human rights reform.

In order for Group members to comply with the Code guidelines, all new employees are provided with a physical copy for mandatory reading. In addition, the Company conducts annual training workshops to familiarize employees with the Code, which are evaluated at the end of the activities to detect areas for improvement and address them, with the aim of achieving a complete understanding of the Code.

KEY PRINCIPLES

OF THE CODE

RESPECT FOR OTHERS

We base our hiring, compensation, promotion and employment decisions on factors such as talent, ability, qualifications and performance. We exclude considerations related to race, sex, color, religion, age, national origin, sexual orientation, gender identity, disability or any other reason that is not linked to the factors mentioned above.

In this sense, the Company seeks to ensure a work environment free of discrimination, retaliation and harassment of any kind, which stands out for:

CONDUCT IN THE

WORKPLACE

We do not accept physical or verbal violence, nor any threat in the workplace, whether made by employees or directed at them or their belongings.

LABOR RELATIONS AND

WORKING CONDITIONS

We recognize and respect the right of our employees to associate in ways that enable collective bargaining, always observing the terms established in Grupo Peña Verde’s collective bargaining agreements.

IDEA ASSETS

Due to the nature of our operations, it is crucial to implement rules and controls that regulate aspects such as access, management and authorization of use of our tangible and intangible assets. These regulations include:

THIRD PARTY

SERVICES POLICY REGULATORY

Only third parties with integrity and good reputation, and who are familiar with and comply with Grupo Peña Verde’s Code of Conduct and Ethics for suppliers will be considered as potential service providers of the Group.

Since all contracts with third parties specify that the third party does not have an employment relationship with Grupo Peña Verde, suppliers undertake to comply with all labor and employer obligations in accordance with current legislation.

POLICIES RELATED TO

REGULATORY COMPLIANCE

ANTI-CORRUPTION POLICY

Grupo Peña Verde is not allowed, directly or through intermediaries, to carry out, cover up or promote bribery, corruption, collusion, bribery and any activity that involves offering or providing any person with rewards in cash or in kind, benefits, privileges, services, assumption of debts or obligations, or excessive attention.

Based on the above, the corresponding actions are implemented to prevent and avoid acts of corruption, both at the Group level and in each of the subsidiaries, taking into account the following principles:

GIFTS AND ATTENTIONS

Receiving bribes, kickbacks, rewards, compensation or other extraordinary payments from any organization or individual that competes with, intends to do business with, or is doing business with Peña Verde is strictly prohibited.

DONATIONS

Donations will not be made in the following cases: i) when requested by a government official, or ii) when a government official is involved in the management of these organizations. All donations are reviewed and approved by the head of the Corporate Legal Department.

POLITICAL CONTRIBUTIONS

In no case shall contributions, whether direct or indirect, be made to political parties, movements, committees, political and union organizations, as well as their representatives and candidates, unless required by applicable laws that may exist.

MONEY LAUNDERING

PREVENTION

Grupo Peña Verde guarantees to collaborate only with clients and suppliers of solid reputation, whose activities and resources are in compliance with the applicable legal framework. In this way, the Company strives not to favor or facilitate operations with resources of illicit origin, financing of terrorism or any other financial crime.

OTHER RELEVANT POLICIES

HUMAN RIGHTS

POLICY

The Group’s Human Rights Policy provides clear and precise guidance for ensuring the dignified treatment of all persons linked to the Company.

DIVERSITY AND

INCLUSION POLICY

The Company’s Diversity and Inclusion Policy establishes the necessary guidelines for continue to promote equal opportunities and more effective decision making.

MAIN MEASURES TO PREVENT

CONFLICTS OF INTEREST

RELATED PARTY TRANSACTIONS

Any transaction between related parties must be carried out at market value and strictly adhere to the Policies for Transactions with Related Parties and Entities, which must be in effect and approved by our Board of Directors.

We consider as related parties: